Table of Contents

It’s 2022, and the world is currently dealing with almost abnormally high inflation rates.

Now, let’s rewind to 2008 for a second. This was the year of an absolute financial crash. Back in the day, high-school freshmen and students were jobless and those who wanted to level up their skills and attend for-profit colleges had no other option but to take out student loans. However, investing in education wasn’t a good idea and some of those degrees soon became worthless. Most people under 30 were unemployed or in debt.

Oil and energy prices also went up, which caused a wave of other price increases. Food prices were up 45% to 65%, the price of rice four x’ed, while the price of soybeans went up by 100%. Most households were spending 50% of their income on food.

If you think living in 2008 was bad, get back to reality. We now live in a post-pandemic world, the war between Russia and Ukraine is raging, social unrest is rising, and prices are soaring.

The main difference between 2008 and 2022 is that, back in 2008, there was no such thing as Bitcoin. Could crypto be our lifesaver now when we’re going through economic turmoil?

What is Inflation?

When fiat money like the euro, dollar, or pound starts losing value, prices of a wide variety of services and goods tend to rise (fuel, metal, oil, labor, and health care, to name a few).

In other words, inflation is the process of losing purchasing power (since you can buy fewer products or services for the same amount of money than you used to a year ago), and it is measured in percentages. The loss of purchasing power and the rising cost of living altogether decelerate the economic growth rate.

Inflation doesn’t necessarily have to be a negative thing. If you own stock commodities or properties, the value of your assets has certainly grown by a significant percentage in the past couple of months.

If you are a borrower, you can benefit from inflation since the value of your debt will likely pare down in time. Still, if you are a saver, inflation will just nibble on your money bit by bit.

How Can Crypto Hedge Against Inflation?

Some of you may ask – is Bitcoin inflation-proof?

Unlike fiat, cryptocurrencies (nowadays considered a bona fide asset class), Bitcoin included, are almost resistant to inflation and cryptocurrency inflation rates are easily predictable.

Keep in mind that even gold can experience mild inflation so it’s nothing unusual that digital assets experience it, too! However, unlike gold, once Bitcoin (also called digital gold) is entirely mined, it won’t be sensitive to inflation anymore.

The main reason this digital currency is inflation-resistant is that its supply is fixed at 21 million, and is, in other words, limited (when it comes to gold, we can’t say for sure whether its supply will ever run out).

Not only does Bitcoin have a limited supply, but the amount of tokens that are mined is reduced by 50% every four years, too. This event is called Bitcoin halving.

Knowing that money sitting in a bank is losing value rapidly due to a high inflation rate, individuals are losing trust in the central monetary system and are now investing their savings in crypto (Bitcoin, Ethereum, and similar cryptos).

One of the reasons for this is the fact that cryptocurrencies are less prone to manipulation and central banks printing more money can actually affect crypto prices in a positive way.

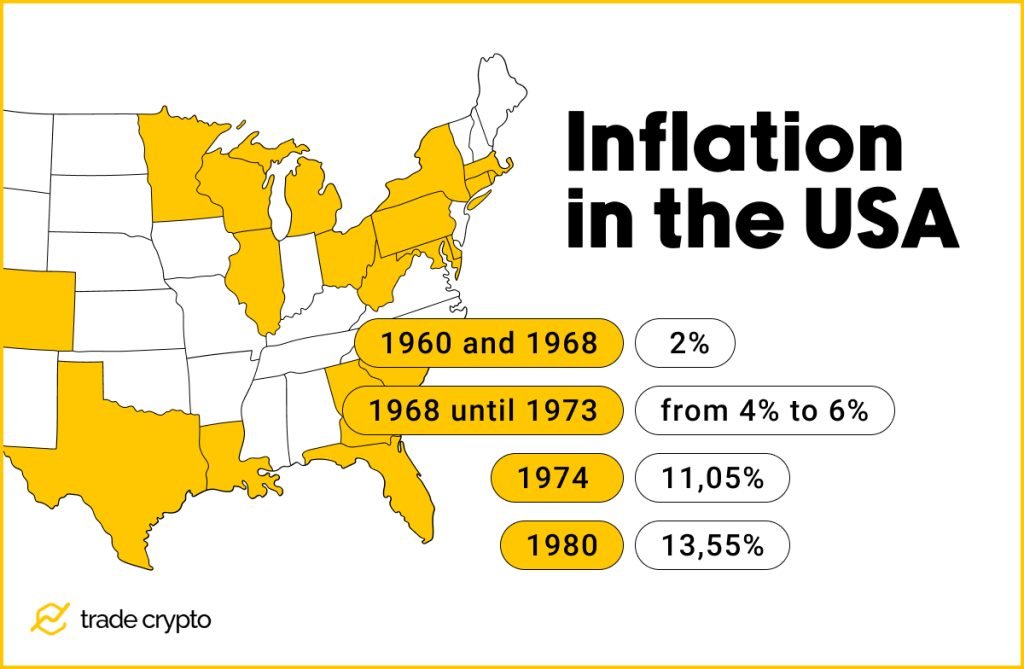

Inflation in the USA (historical data)

As already mentioned, inflation may not be as bad as it seems. What’s more, a certain degree of inflation (2%) is highly desirable and considered healthy.

Inflation between 1960 and 1968 was, on average, 2%. From 1968 until 1973, it varied from 4% to 6%. It reached a double-digit number in 1974 (11,05%) and an unbelievable 13,55% in 1980. However, inflation in the US hit 17,80% back in 2017, which was the highest inflation rate ever.

The US is currently going through a period of the highest inflation since 1980. It reached 8.5% in 2022. According to some estimates, it should get back to 2.7% by 2023 and then to 2.3% by 2024, although we can’t say that with certainty.

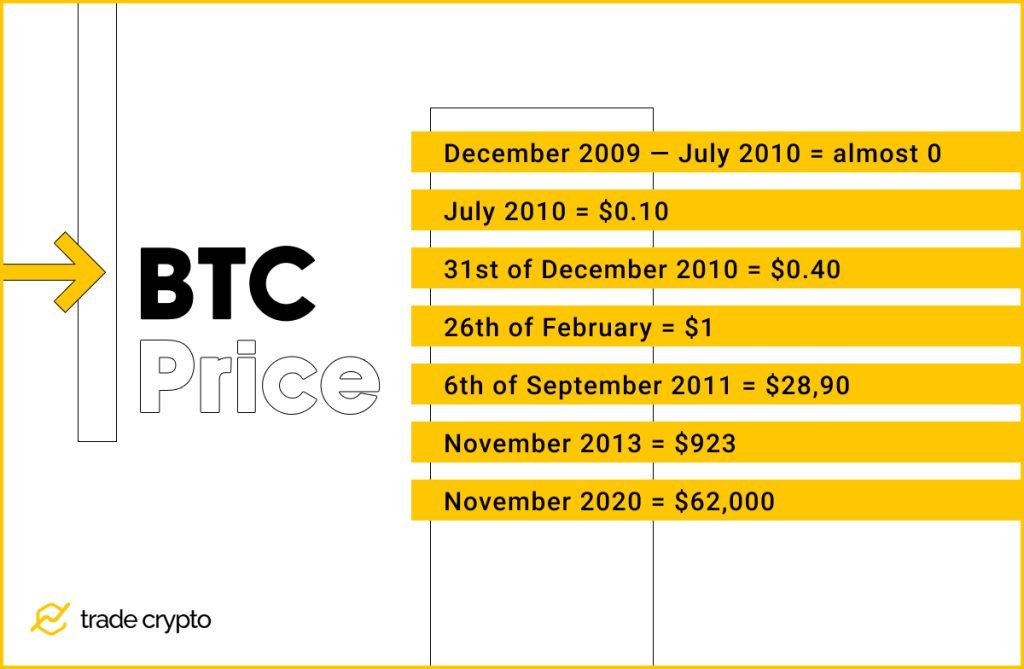

BTC Price (historical data)

On the 1st of December 2009 and lasting until the 19th of July 2010, the value of one Bitcoin was practically zero. Then, in July 2010, it hit $0.10. On the 31st of December 2010, it was priced at $0.40, on the 26th of February it peaked at $1, dropped a bit shortly after, and got some traction in April 2011 again.

On the 6th of September 2011, Bitcoin was traded at $28,90 and was selling below that price for almost two years, until the 24th of February 2013, when it sliced through $100 for the first time, and almost hit 1,000 before the end of the year ($923 on the 27th of November).

It took almost four years for Bitcoin to finally pass this resistance level. It hit $1,044 on the 4th of January 2017, and experienced a massive pump that pushed it to $17,760 on the 20th of December 2017.

Again, it took three years to get back to this level after the consolidation. On the 23rd of November 2020, BTC started a rally and hit $62,000 on the 15h of April 2021. Then, its value was literally halved to $31,533, prior to rising back to $69,044 within the same year. Since the beginning of 2022, Bitcoin and other cryptocurrencies have been going through a tough time, or, what experts like to call it – the crypto winter.

Even though the value of the entire crypto market is now shrinking, it’s safe to say that Bitcoin has significantly increased in value. It went from being almost worthless to the $69,000 figure in just 13 years. Although the most popular cryptocurrency is currently sitting at $19,000 and the entire market is in the red, the overall trend for most cryptocurrencies over time has been that of rising values.

Alternative Methods of Hedging Against Inflation

Once you get to a point when your salary doesn’t stretch as much as it used to, you should start thinking about ways to counter rising inflation.

Not long ago, the public thought of high-yield saving accounts as the best hedge against inflation. They’re called “high yield” since you get higher yields compared to those you get with a savings account. High-yield saving accounts offer 1.5 APY (annual percentage yield) on average, while saving your money in a bank brings 0.1% APY.

Suppose you, for any reason, don’t like high-yield saving accounts or would simply want to diversify. In that case, you can go for treasury bonds – series I savings bonds or treasury inflation-protected securities (TIPS), whose price is adjusted when and if inflation rates go up.

To hedge against inflation, you can also invest in stocks that typically provide 12.3% of ROI per year. The growth in money supply has an almost immediate effect on the stock market and other assets priced in fiat currencies. Indeed, stocks can experience dips, too, but you can, again, diversify to minimize risk and invest in different kinds of stocks (domestic and international).

Gold, silver, and other precious metals are also considered to help avoid the dangers of inflation.

Aside from these traditional inflation hedges, there’s crypto, a safe haven for millions of people worldwide who think of it as a way to improve their personal finance.

Fun fact: since the beginning of 2020, more than 15% of the global population has invested their money in precious metals, while more than 5% has invested in cryptocurrencies. In other words, rather than embracing traditional forms of hedging against inflation, people started turning toward Bitcoin and precious metals, gold in the first place.

This new investment vehicle sounds tempting, however, due to the number of scams in the space and the risks that the crypto market carries within, we still can’t say if investing in digital assets is the most effective way to protect your funds from inflation.

Pros and Cons

It’s totally understandable that you want to protect your funds or savings from the negative effects of inflation. Investing in assets you believe will increase in value can be a wise move. However, although all of the instruments we’ve mentioned – stocks, bonds, precious metals, and crypto can provide a reasonable rate of return, you should keep one thing in mind…

If you are receiving 5% APY on your investment, but the inflation rate is, let’s say, 8%, then you’re actually losing 3% per year. Thus, you should invest in assets that offer returns greater than the rate of inflation.

There’s no magic pill to hedge against inflation since no instrument can guarantee significant returns or at least returns that surpass the inflation rate. Besides, inflation is not the only factor that can impact different types of investments.

Although there’s no doubt that you’re losing if you just hold cash, you also risk losing some of your capital even if you invest in real estate, gold, or crypto, especially in the short term, simply because of the common and frequent market shifts currently going on.

Risks of Hedging Against Crypto

Some digital currencies are pegged to fiat currencies. These are popularly called stablecoins and are less volatile than Bitcoin and other currencies. However, on the downside, inflation can impact stablecoins just like it can impact fiat currencies like USD or EUR, and, thus, your investment may lose value after some time and never go back.

Crypto enthusiasts are firm believers that cryptocurrencies won’t depreciate with time. However, the argument that Bitcoin can be an effective hedge against inflation has weakened during the past couple of months simply because Bitcoin’s price has tanked 70% since the end of 2021. This was the result of the Federal Reserve raising interest rates, consumer prices heating up, the war in Ukraine, and several other factors.

Even the most popular crypto exchanges like Coinbase and Gemini had to cut losses and lay off a certain percentage of their workforce due to the concerning situation in the cryptocurrency world.

On the other hand, crypto investing can be a wise move to make since, thinking long-term, there’s a chance that cryptocurrencies will get widely accepted sometime in the near future. This would reduce the volatility, instill trust, attract more people to the space, and truly make crypto the best hedge against inflation.

Conclusion

Bitcoin and other cryptocurrencies can be used as a good inflation hedge, however, the current climate, to a large degree, still doesn’t allow relying on crypto assets. Crypto can be used as an inflation hedge only when we reach the point of mass adoption.

Blockchain technologies hold massive power, and most crypto enthusiasts see crypto’s future potential. However, we will have to wait for another couple of years until we can truly and fully trust this system.

Crypto Ping Pong Digest

Trash style news. You will definitely like