Table of Contents

Greed is Good?

Let us admit to ourselves – before blockchain technology and crypto came about, we had seen trading financial assets only in the news or in movies. The world of Gordon Gekko or Jordan Belford (AKA The Wolf of Wall Street) seemed like a perpetual cycle of excitement, action, making tough, life-changing decisions, and living large.

Though neither Gekko nor Belford were paragons of virtue, their ability to see through the invisible rules that govern the stock markets intrigued us and made us think whether we would be able to somehow do the same.

Trading Financial Assets, Now Available to Everyone

With cryptocurrencies and crypto exchanges, the once forbidden world of financial trading became available to every Tom, Dick, and Harry. Fueled by media-induced fear of missing out (more about that later), freshly made crypto traders started looking for a quick buck, only to discover the eternal truth of trading – some people win, many people lose.

As that truth is fully applicable to all forms of cryptocurrency trading, we would like to introduce to you some basic parameters of trading on crypto exchanges that will help you maximize profits and minimize losses.

What is Cryptocurrency Trading and is it Different from Traditional Trading?

Cryptocurrency trading is done in two main ways:

- Buying, selling, and swapping digital currencies on an exchange;

- Speculating on cryptocurrency price movements via a CFD trading account.

The first way is easy to grasp – you buy cryptos at the lowest possible price and sell them at the highest price you can get. We admit it is easier said than done, but the concept “buy low, sell high” is the cornerstone of every trading, cryptocurrency included.

Also, you have probably heard “to go short” or “to go long” on an asset. The difference here is what you believe will happen. If you are longing an asset, you buy it convinced its price will rise. Shorting an asset is your profit-making action based on your belief that the asset’s price will drop. Shorting itself is a bit more complicated and will be explained in more detail later.

Steps on How to Trade Crypto

Step 1. Sign up for a Cryptocurrency Exchange

There are many crypto exchanges to choose from but stick to those verified by the community. We have mentioned a few of them (Binance, Coinbase), but there are many others. When you are selecting an exchange, you should pay attention to several parameters, such as fee structure, how you like its user interface, does it deal with currencies you want to trade, and whether it supports trading from the country you reside in (the exchange will alert you if your country is not supported).

In the process of signing up, you will be asked to provide some personal information that verifies your identity: place of residence, date of birth, Social Security Number (USA) or Personal Tax Number (EU), email address, cell phone number, a government-issued personal ID with a photo, etc. This process is called KYC (Know-Your-Customer) and it is a part of security measures used to prevent any possible abuse of the exchange platform.

Users may see a KYC process as a nuisance, but it is crucial for keeping everybody’s assets safe, including yours.

Step 2. Fund Your Account

Once you have successfully finished the KYC verification, you will be allowed to fund your exchange account with fiat or crypto money. Funding usually means topping it up by using your bank payment card. Follow the instructions step by step and do not transfer too much money at first. You want to be comfortable with how things work, there will be time to do it again when you want.

Also, if you by any chance already have some cryptos in your personal wallet, you can transfer them to your exchange account.

Once you see your fiat (ordinary) or crypto money in your exchange balance, you are ready to start trading.

Step 3. Choose Which Coins to Trade

You can choose well-known coins like BTC, ETH, BNB, etc., invest in less-known alt-coins, or in new ones that are created through the Initial Coin Offerings (ICOs), or delivered by airdrops. Our ICO calendar can help you with that.

You do not have to limit yourself to trading only one coin. You can trade several coins at the same time, but it is recommended that you keep an eye on the one(s) you have decided to prioritize.

Step 4. Choose Your Trading Cryptocurrency Strategy

Selecting a trading strategy that is suitable for you means identifying your risk appetite and sticking to it.

Some investors are more risk-prone, while others are risk-averse. According to your personal risk-taking preferences, you can be a conservative, moderate, or aggressive trader. However, whichever strategy you opt for, invest only you can afford to lose!

Step 5. Store Your Cryptocurrency

There are two main types of wallets where you can store your coins/tokens – software and hardware. Both kinds are considered safe, but hardware ones are one step safer because they are not connected to the internet.

Software wallets can be web, desktop, and/or mobile-based (an app) and they bring a higher degree of convenience in frequent use. Hardware wallets usually look like ordinary USB flash drives and they are used by those people who own some significant amounts of crypto.

Coins can be stored in your exchange account, too, but that is the least safe storage option and should be done only during periods when you actually trade on the exchange.

Step 6. Have an Exit Strategy

Exit strategy refers to both things going South or cashing out the profits.

If you have sustained losses because of a market crash or bad investment choices, prolonged trading will not guarantee you the recovery of those losses. Sometimes it may be wiser to lay low for a while, suspend trading and wait until the conditions get better.

On the other side, if you have managed to earn some profits, you can decide to re-invest them or cash out, partially or entirely. Being profitable feels good, but do not forget that those profits are by definition subject to taxation.

What is the Difference Between Trading on Crypto and Traditional Markets?

“Traditional markets” is actually not the best term used here as there are many types of them, facilitating the trade of various goods, from natural gas to pork, gold, and soybean. The comparison is most often done between crypto and the stock market because they look (and are) similar in many aspects. However, there are some key differences.

Cryptos vs. Stocks: Differences

Assets Traded

While stocks are parts (shares) of ownership of a company, cryptocurrencies are a completely separate and special asset class.

Exchanges and market maturity

Cryptocurrency exchanges are relatively new. Binance, the largest one, has been active since 2017. Another cryptocurrency exchange – Coinbase was launched in 2012. Binance has had a peak 24-hour trading volume of US$76 billion.

On the other hand, stock exchanges have been around for over two centuries. Nasdaq has a trading volume of US$ 300B on the day this article is written. And Nasdaq stands for a tiny fraction of the global stock market.

Liquidity

Liquidity is the indicator of how easily an asset can be converted into cash without affecting its market price and it should be one of the key factors when selecting a cryptocurrency trading platform. Stocks are generally considered liquid, but the liquidity of digital assets varies from one crypto exchange to another. Low liquidity can severely impair trading and cause losses to an investor.

When you sell digital currencies, your supply has to be met with adequate demand from the other side. If that is not the case, you will either be unable to sell or you will be forced to sell under unfavorable pricing conditions (slippage).

Liquidity is often confused and conflated with volume. The relationship between liquidity and volume is close, but high volume does not necessarily mean high liquidity. Trading volume is only a measure of the value of executed trades within a period. Liquidity, on the other hand, is about the value of buy and sell orders that are currently on the order books.

Volume is a measurement of the trades that have already taken place, while liquidity indicates the number and value of transactions that are placed for (future) execution.

What is Wash Trading?

Cryptocurrency exchanges that have high trading volumes attract more traders. Unfortunately, many exchanges have engaged with wash trading – a fraudulent activity of buying assets through one broker while selling them through a different one, often done by crypto trading bots.

By creating false volumes, those exchanges try to display their liquidity and popularity and increase the price of (usually) some obscure tokens. A gullible user attracted to such exchange learns immediately the difference between the volume and liquidity – once he/she has placed a buy order for less known coins, they will realize that selling them is either impossible or loss-incurring, as the fact no one who wants to buy the manipulated asset.

Volatility

Volatility is the term used for describing how sharply an asset can go up or down in price in a short time. The stock market can be pretty volatile, but most cryptocurrency exchanges are even more volatile, together with all currencies observed together.

Volatility is a bit more bad than good because drastic changes in the value of assets can disrupt investment plans, techniques, and almost every trading strategy. It can, of course, lead to immense and instant financial gains, but can also have a cataclysmic impact on one’s financial well-being.

Trading Hours

Crypto markets are open 24/7/365, while stock markets are only open during business hours in their specific home country.

Trading Fees and Costs

Those eager to invest in crypto have to sustain lots of costs in form of charge fees and gas fees. Every crypto currency exchange has its fees for buy and sell orders, and some networks will boost gas fees if you want your transaction to be prioritized in realization.

The good news for crypto investors is that the stocks are even more expensive.

Basics of Cryptocurrency Trading

Roman philosopher Seneca once said that “Luck Is What Happens When Preparation Meets Opportunity“. Crypto trading probably will not become your profession, but it does not mean you should not be well prepared. Learning and understanding some key concepts and related phenomena will help your account be in black.

What Kind of Trading is Good for You?

Spot Trading

Spot trading is the process of buying and selling cryptocurrencies at real-time prices to generate profit. Buy low, sell high, remember?

There is no “one size fits all” rule on how to achieve this. Sometimes, you will buy some coins and sell them a few hours later for a higher price. Sometimes, you will have to be patient and wait days, weeks, or months to sell what you have bought in order to generate profit.

Knowing when to buy, when to HODL, and when to sell is something you learn through practice. Short-term gains are seductive, but there will be times when you will learn that patience really is gold.

Margin Trading, CFDs

If you are just starting your crypto trading journey, CFDs (Contracts for Differences) and margin trading should be something you may try a bit later.

CFD/margin trading allows you to speculate on cryptocurrency price movements without actually taking ownership of the underlying coins/tokens.

Margin trading is actually borrowing money from the platform to purchase crypto. Why do you do that?

For whatever reason, you firmly believe the price of a crypto coin will rise or fall. If your prediction is correct, you earn a profit that is paid to you by the platform. However, if you are wrong, you pay them.

For example, you borrow 10,000$ when the price of a coin is 100$ per unit. If the price goes 50% up to 150$/unit, your position will be worth 15,000$. You give back 10,000$ to the lender (plus fees) and you earned 5,000$.

Basically, it is placing a bet. Your profit or loss is fully dependent on the price movement of an asset you have bet on, and without actually owning the traded asset.

Leverage

CFDs provide leverage. It is a CFD’s property to allow traders to trade multiple times the amount of their chosen crypto compared with buying it directly. It multiplies both profits and losses – depending on the trader’s success to predict the price movement correctly, leading a trader to a possible huge instant success or financial distress.

How do Supply and Demand Influence the Markets?

Cryptocurrency markets move according to supply and demand. As we have pointed out, there are only two types of players in the markets: sellers and buyers, both groups trying to maximize their trading scores.

In a perfect environment, supply and demand would be the only decisive factor in forming the price of the assets. In reality, there are numerous additional factors (both legitimate and illegitimate) that can affect the market movements and influence your trading performance.

What Other Factors Have Influence on Market Prices?

Until recently, the behavior of crypto markets was so hard to understand that it was often labeled as ‘capricious’ or ‘illogical’.

Things have changed. Nowadays, analysts observe correlations between crypto markets and economic and political concerns that affect traditional stock markets, too.

News about a war, inflation, recession, or traditional markets spiraling downwards affect crypto prices and can cause serious damage to the liquidity of exchanges and the overall market. No crypto market is an island anymore.

Some additional factors can have a significant impact on a cryptocurrency price:

- Supply: the total number of coins.

- Market capitalization: the value of all existing coins.

- Media coverage: The portrayal in the media and whether it favors it or predicts its failure.

- Integration with the “real world”: the extent to which a cryptocurrency is integrated with existing financial and commercial infrastructure.

- Key events: announcements, putting a coin into circulation, regulatory updates, security breaches, etc.

As you can see, some of these factors are psychological and based on human emotions like fear, greed, anxiety, or malleability. That is why emotions play an important role in the psychological cycles of the market, which we will explain later.

What Is an Exchange Order Book?

The order book is a list of “buy” (bid) and “sell” (ask) open i.e. unexecuted orders for a specific trading pair. It is a virtual section of an exchange where sellers of a particular crypto trading pair meet buyers.

An open order stays in the order book until it is canceled or someone accepts the bid or agrees to pay the asking price. Each trading pair, (e.g. BTC/USD or BTC/ETH) has its separate order book.

By scrolling through an order book and looking at bid/ask price ranges, you can get a decent picture of the current trading intensity, liquidity, and short-term price movement.

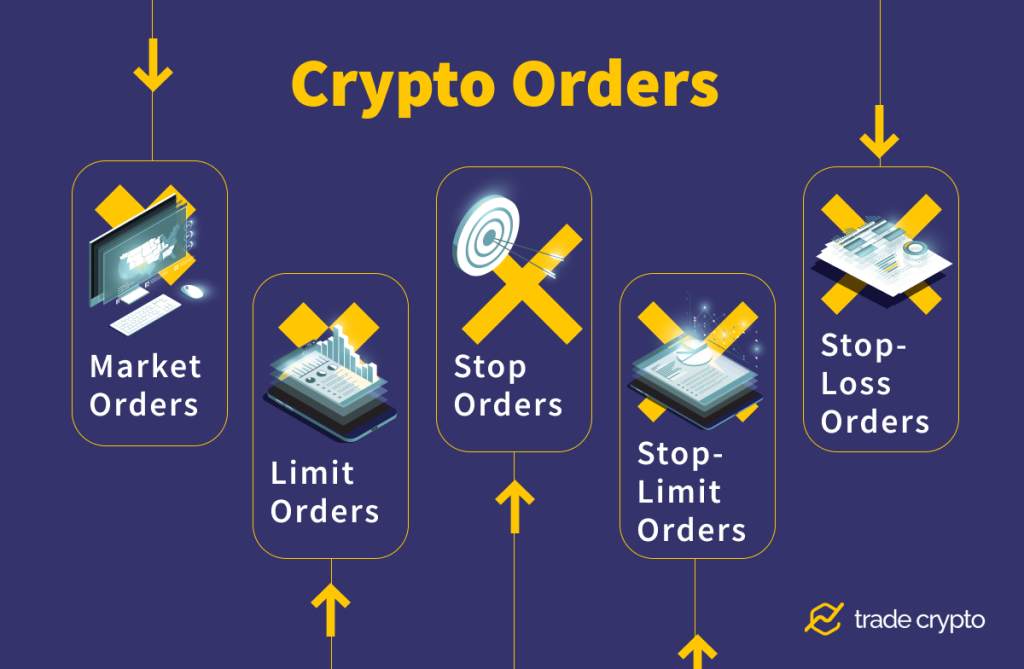

Crypto Orders: Types of Orders and Which Ones Are Better

Different crypto market orders reflect different traders’ intentions regarding buying or selling cryptocurrency, whether they want to target a specific price or define the timing of the transaction.

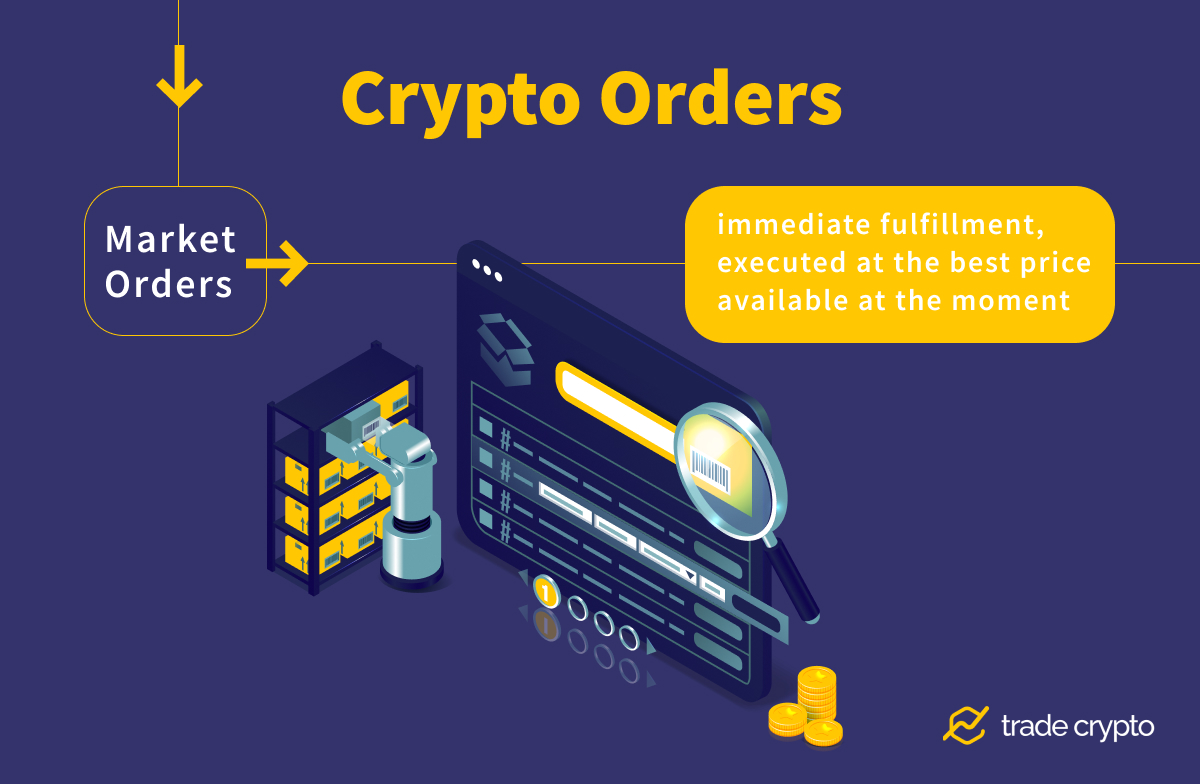

Market orders

The market order is the simplest and most basic type of crypto order. It is a trading instruction issued by a trader where they instruct the platform to immediately execute buying or selling a coin at the best available price.

Market orders provide immediate fulfillment of the order. It is designed for traders who do not want to wait until the asset reaches a certain target price but to be sure their trade will be executed at the best price available at the moment of execution.

Every individual market order placed equals one entry less in the order book. The thinner the order book is, the less liquidity there is in the market. Because of that, exchanges do not prefer them and usually charge higher fees for them.

Slippage is a significant drawback of market orders. It happens when an order is fulfilled at a price lower than expected. It usually happens because there is not enough liquidity to fill a large order at the desired price, so the next available (lower) price will fill in. If the size of the trade is considerable, slippage may lead to a big loss for a seller.

Limit Orders

The limit order is an instruction to buy or sell a cryptocurrency only at a price specified by the trader. It is best suited for the trader who can patiently wait for a price target to be reached.

Limit orders give more flexibility than market orders. They let traders set a minimum price and will only execute at that price or higher. This allows traders to have better control while granting them the option of staying away from monitoring the market constantly.

Limit orders are only fulfilled if the pre-defined price is reached and execution is not guaranteed, because the orders are first ranked by price and then on a first-come-first-serve basis. So, once the designated price is hit, the order might still not be executed because other previously placed orders of the same amount are waiting to be filled.

Many traders set the limit price a little above the selling price or below the buying price of psychological threshold levels (round numbers). Whether you use this approach or not, it is always recommended to look at the order books to make out the prices that do not reflect many orders to have a better chance for their execution.

Limit orders are new entries in an order book and therefore boost the liquidity of the exchange.

Stop orders

With the stop order, the sale of an asset is delayed until it hits the pre-defined price. When that happens, a stop order becomes a market order.

A stop order can be given in two opposing directions (or both).

For example, you bought your coins for 10$ per unit. The marketplace is shaky, prices rapidly go up and down. What can you do? You can issue an order to sell all your holdings if the price hits 8$. Why? To minimize loss, just in case the price drops even more.

On the other hand, you can set a stop order if the asset price reaches 14$ because you are satisfied with 4$/unit profit and you believe that is the maximum you can get from that trade.

Stop-limit orders

The stop-limit order is an advanced order type combining a stop order and a limit order. They are similar to limit orders, but they are more flexible.

A stop-limit order is not instantly executed and it will activate buying or selling the cryptocurrency only when the stop price is reached. When that happens, a stop-limit order transforms into a limit order, allowing traders to have precise control over how their order is executed.

Stop-loss orders

The stop-loss order is a trading risk management tool as it automatically closes a position when the price reaches a predefined (low) level. It is especially useful and widely used when a bearish trend occurs and the price of an asset is expected to go further down.

Market Analysis: How to Master Seeing Through the Markets?

Buying a digital asset low and selling it high is easier said than done. Recognizing lows and highs is hard, without any guarantee a forecast event will occur.

Fortunately for traders, some techniques provide them with data that help them reach correct decisions on entering or selling digital assets. The two most frequently used are technical analysis and fundamental analysis. When combined, they can substantially improve a trader’s chances of making a profit.

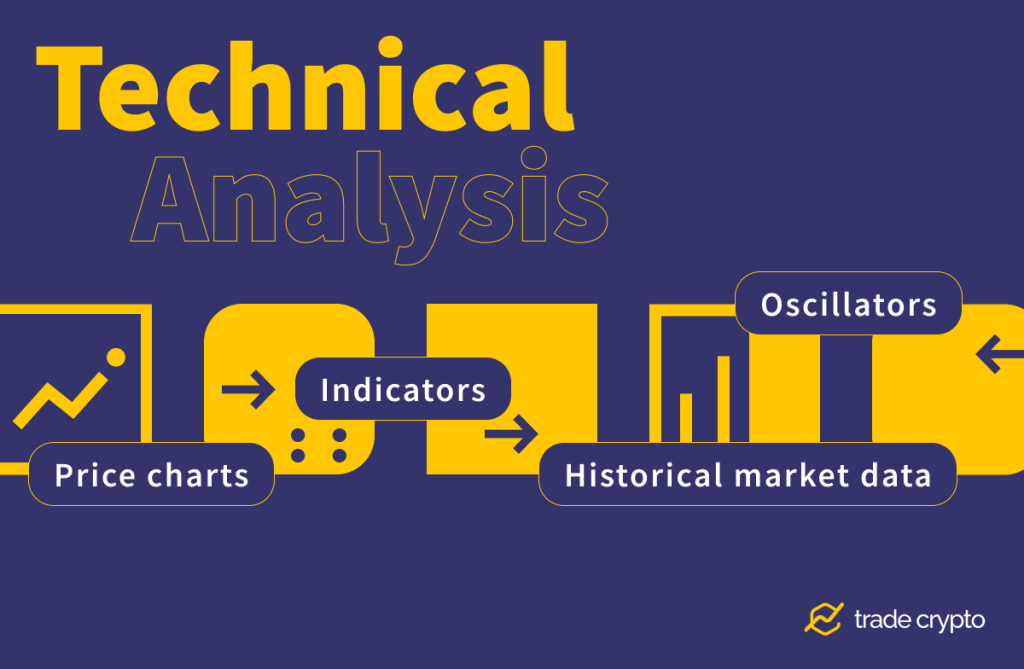

How is Technical Analysis Done?

Technical analysis (TA) is built on the premise that finance historical events repeat. Its key element is historical market data, especially trading volumes and asset pricing trends. It disregards the current price actions of a digital asset, except when comparing them with those recorded in the past.

The main goal of the technical analysis is to identify patterns and repeating behaviors. This analytical approach assumes that price movements can be predicted by looking at the past. Mind, however, that the events from the past never actually re-create themselves in full. Let us give you an example.

Calendar Anomaly

There is something related to trading financial assets called calendar anomaly. It is about unusual and significant price changes that occur regularly at certain periods of the year.

When trading cryptocurrency – Bitcoin in particular – this anomaly seems to appear around every Chinese (Lunar) New Year. BTC prices tend to dip every January, which is coincidentally always 4–6 weeks before Chinese New Year.

TA does not bother much with why that happens. It just says: “Well, if this has happened every January for the last five consecutive years, the chances that the same thing will happen next January, too, are high”.

In-depth TA which involves complex calculations with charts, candlesticks, and other fancy stuff will basically tell you absolutely the same. Still, with more precision – it will try to guess the exact ranges where Bitcoin’s price might end up during the upcoming Chinese New Year.

However, trading crypto is a new trading discipline and the data from the past are still limited. We simply do not possess enough information from the past to create a precise view of future happenings and market trends.

Profiting from Identifying Support and Resistance Levels

Support and resistance are a part of technical analysis and are used by traders to identify the price levels on charts that tend to act as barriers, preventing the price of an asset from getting pushed further downwards or upwards. The process of technical analysis in most cases starts with this step.

Support is a price level that acts as a solid floor by preventing the price of an asset from dropping below that level. The ability to identify a support level is usually a buying opportunity because this is in most cases the area where market participants start to buy and push prices higher again.

Resistance occurs when an uptrend is expected to pause due to a concentration of supply. In technical analysis, it is a price level that a rising stock cannot seem to overcome. Once a stock reaches its resistance level, it often stalls and reverses its direction downwards. Resistance is caused by selling that overpowers buying.

When you think you are seeing a zone of support or resistance, it is the right time to start buying and selling, respectively. Of course, a coin can breach those barriers and continue to rise or fall and in that case, the analysts say a new support/resistance zone is created.

Understanding Crypto Market Cycles

Support and resistance are mostly static parameters of a market. Getting a bigger picture when performing a TA and mastering how to trade cryptocurrency is understanding market cycles.

Market cycle is a regularly occurring phenomenon and is included in the crypto trading strategy of experienced crypto traders.

A market cycle is a peak-to-peak period, with four stages: Accumulation, Greed (Mark-up), Distribution, Fear (Mark-down), and repeat.

- Accumulation phase: The market has bottomed, and early adopters, smart money, and skilled institutional investors – all those who are going against the tide – see a buying opportunity.

- Mark-up phase: the market seems to be in a stable state of equilibrium, the early majority are jumping back in, while the smart money is cashing out.

- Distribution phase: sentiment turns to slightly bearish, prices are choppy, sellers are starting to prevail, and the end of the rally is near.

- Mark-down phase, hesitant market participants try to sell and salvage what they still can by closing their trading position, while smart money investors perform ‘bottom-fishing’ (“buy the dip when the blood is in the streets”).

The cycles in the crypto world are somewhat special because the crypto markets move more quickly. Cryptocurrency prices fluctuate 24/7/365 and price movements are erratic from time to time.

Besides, there are many individual retail investors, whose inexperience makes them especially susceptible to performing acts based on primal psychological impulses and instinctive behavior modes fueled by fear and euphoria. Those powerful emotions, combined with a mixture of greed and fear of losing create psychological market cycles.

Psychological Cycles, Bubbles, FOMO and FUD

If you were an emotionless robot, all you would have to do in a cryptocurrency market is to buy at the bottom (accumulate), ride the wave up, sell during distribution, and then exit the market on its way to hitting the bottom.

But, human emotions are powerful and cannot be left out of the equation. Market mechanics are deeply affected by those emotions which in turn leads to bubble-and-burst cycles.

If the market goes up for a substantial amount of time, demand will reduce the supply of coins for sale and the price will increase. As the price goes up, you can expect that at some point the people are going to cash out. As they sell, supply begins to outweigh demand, causing the price to go down.

There are five steps in the lifecycle of a bubble:

- Displacement

- Inflation

- Absolute euphoria

- Profit-taking

- Panic and the bubble burst.

The psychological factors kick in especially hard if the upward trend is prolonged. That is a moment when a market bubble is created. A bubble exists when the price of an asset exceeds its real value by a large margin. Bubbles are extremely hard to be evaluated properly and forecasting when they will burst is more often lucky-guessing than an exact science.

What is FUD and What is FOMO?

FOMO stands for Fear of Missing Out. FOMO is an expression of human behavior based on greed and going with the tide. It is marked by a rapid increase in purchase volume, typically causing the price of an asset to increase. FOMO causes something called panic buying, as the non-professional investors are afraid they will otherwise miss a golden opportunity to make money.

FUD means Fear, Uncertainty, Doubt. FUD is a powerful agent of spreading fear among investors who try to avoid losses. FUD can emerge spontaneously, but there are techniques to artificially boost sharing the bad news which is engineered mostly by subjects betting on the decrease in the price of certain crypto coins, enticing panic selling.

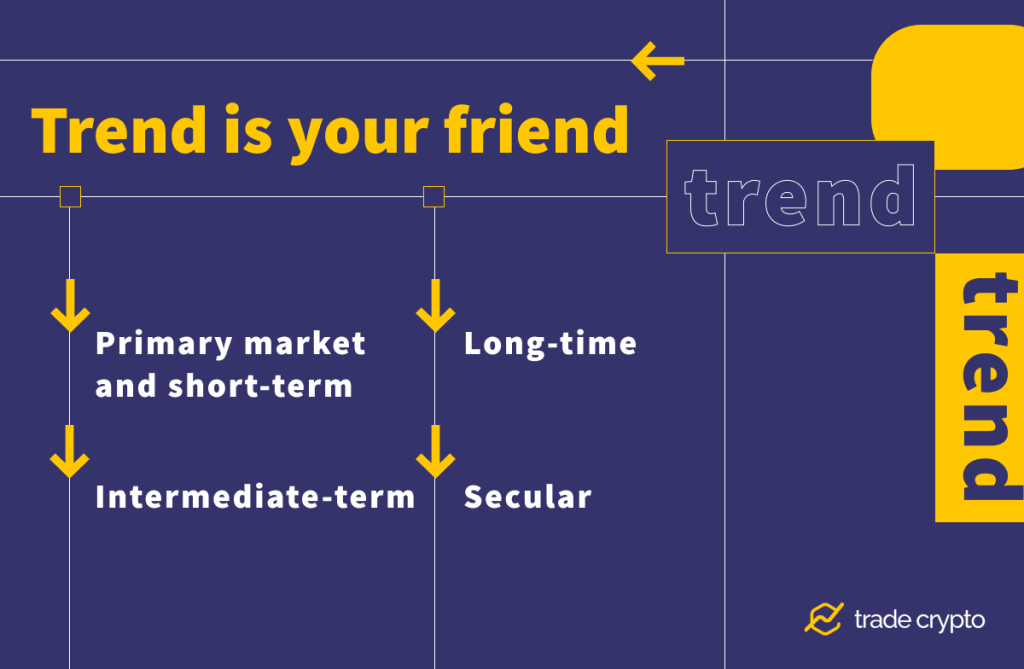

Why is it Important to Follow Trendlines?

“Trend is your friend”. Swimming against the tide poses a significant risk to investors and crypto trading is no exception. There are 4 major temporal trend types, ranging from (a part of) a day, stretching to several decades:

- Primary market and short-term trends

- Intermediate-term trends.

- Long-time trends

- Secular trends.

A primary market trend is a very short time frame ranging from the moment of placing a new coin into the circulation (market) to the first few minutes/hours of trading.

The other three time-related trend types may overlap and can go up to 80 years (e.g. the period from WWII until today), but they are usually confined between two major global economic crises (e.g. 2008 – 2022).

Trendlines are drawn lines that give an investor an idea of the direction an investment might move in. Which trendline an investor or analyst will consider more important than the others depends on the timeframe of the investment. In turn, the timeframe depends on one’s investment strategy. While many investors chase a quick buck, there are more than patient believers who can HODL their cryptos seemingly forever.

Warren Buffet once said “Our favorite holding period is forever ” and we are sure he and his team did some exceptional analyses regarding secular trends which cover periods of 20 years and more.

Unfortunately, there is also a second part of the proverb and the full version is: “Trend is your friend until it bends”. With cryptos, both trending and bending are regular occurrences.

Bears vs. Bulls

Bears and bulls are common terms that reflect general market conditions. i.e. whether the price of assets is rising or falling.

Bull market is a market on the rise.

Bear market is characterized by the prices of assets going down.

The majority of investors are always more bullish than bearish – that is simply human. Although skilled investors can make money even in a bear market, such a trend is more dangerous, and unexpected moves can shake even the well-prepared ones.

The most important and difficult task is to pinpoint the peak of the bull market and/or the bottom of the bear market.

Riding Bulls

A bull market generally lasts until prices have risen for so long that investors begin to believe that it will last seemingly forever. This mass delusion is so strong that it influences the prices themselves in a self-fulfilling prophecy. This is a phenomenon that refers to investors creating the market circumstances themselves – the prices go up because investors are causing the prices to rise.

Coping with Bears

A bear market occurs when a market experiences prolonged price declines ranging from 20% to +90%.

There are 4 major phases of a bear market:

Recognition. A single bad week does not mean the arrival of the bear. Prices fluctuate, going up and down all the time. The bear is among us only when prices continue to steadily drop for weeks or months, losing 20% or more in value.

Panic. Once visible and recognized, a bear causes panic. Support levels are broken many times, rock bottom is not anywhere near, and “buying on the dip” has produced even greater damages to the portfolio.

Stabilization. The decline is halted. The panic is no more there, but there is anxiety and hesitation. Investors are afraid that the dip will continue. We can name this phase a desperation in silence or extreme pessimism.

Volatility is intensive, cryptos rally and get knocked back down. The market sentiment is sometimes between cautious guarded optimism that the end of the ordeal is near, and despair that the hope is false.

This is typically the bear market’s longest period and is followed by anticipation.

Anticipation. begins when stocks start to recover. Similar to the beginning of a bear market, the anticipation phase is unrecognizable at first.

Round Numbers

As we have said, many traders set the limit orders a little above the selling price or below the buying price of psychological threshold levels (round numbers). That happens as a result of the fixation on round-number price levels by some investors.

When a large number of executed and pending orders focus around a round number it can be difficult for the price to surpass this point, creating a round-number resistance.

Moving Averages

A market history can be visually represented by numerous downward/upward trendlines. In order to make things easier to digest, traders often polish up data to create a single visual line representation called the moving average. When analyzed with respect to trading volume, the moving average provides a useful indicator of short-term trend acceleration.

Chart Patterns

The most frequently used visual representation of market price action is the candlestick. Candlestick patterns are used as a visual aid for traders to anticipate emerging and ongoing trends.

A candlestick chart features four price points: open, close, high, and low. Interpreting candles on a chart will help you a lot with mastering the techniques of trading.

They are called candlesticks because of their rectangular shape and the lines above and/or below that resemble a wick. The wide portion of the candle is where the price either opened or closed, depending on its color. The wicks represent the price range in which an asset is traded during the set period the candlestick depicts. Candlesticks can embrace different timeframes, from 30 seconds to 5 years or more, giving an insight into the chosen trend.

Who Are Crypto Whales and Why Are They Important?

A cryptocurrency whale, (“crypto whale” or “whale”) is a term that refers to individuals or entities that hold large amounts of a cryptocurrency. A person that has the whale status cannot be easily identified, but their activity on cryptocurrency exchanges (and every other one) can be monitored via platforms that monitor transfers done over a selected blockchain.

The importance of whales is tremendous. As they may hold 10% or more of a coin, they can have a strong influence on the markets and the respective currency valuations.

The existence, role, and power of whales over the prices of digital assets has been one of the strongest arguments against the whole crypto ecosystem. The democratization of finance brought by decentralized crypto monies is severely diminished by whales. But, as the market capitalization of coins increases, the influence of whales should become less and less pronounced.

Especially mysterious are the dormant whales – wallets that have not had any activity for years. Their origin and role are unclear. Although they may be simply abandoned (deceased owner, lost wallet password, etc.), some speculate that they are hodlers who are waiting to trade the Bitcoin they own when its price reaches unbelievably high price levels.

Companies like Sequoia Capital or MicroStrategy have been important to the blockchain ecosystem because they actually put their money where their mouth was when they lauded cryptocurrencies and their importance to the world of finance. On the other side, there is Elon Musk, “an occasional hodler” for whom it is unclear whether he has done more good or bad for coins he had purchased and then conveniently sold after.

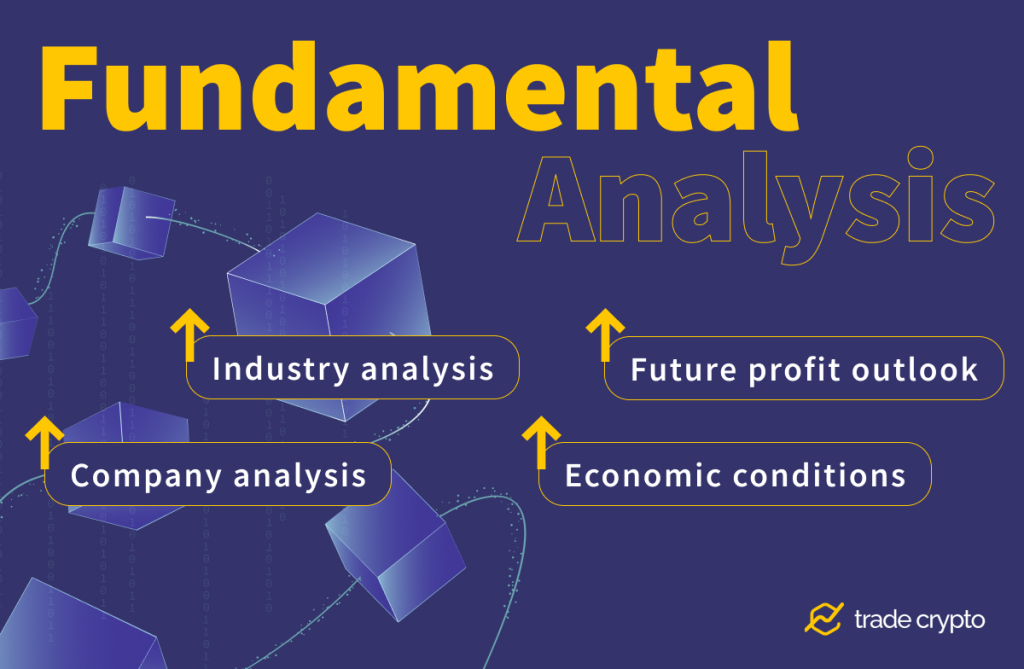

How is Fundamental Analysis Done?

Fundamental analysis (FA) is a method of establishing the real (“intrinsic”) value of an asset by examining economic and financial facts related to it.

Fundamental crypto analysts take into account everything that can affect the coin/token value, starting with a big picture like the overall state of the global economy, down to very specific factors like the effectiveness of the company’s management or the existence of the project’s real use cases.

The end goal is to determine the concrete value – a number that an investor can compare with the asset’s current price to see whether it is undervalued, overvalued, or the current market price is adequate.

It is very hard to calculate the real value of a coin because it has a lot to do with people’s perception of it. If a coin can solve some real-life problem or provide added value to people’s lives, its intrinsic value rises. Bitcoin, for example, makes financial transfers between ordinary people easy and cheap and that is a part of its real value.

On the other hand, if the price of a coin goes up without an apparent reason, it should be assigned to human psychology and anticipation that it will be successful.

Fundamental and technical analysis are two faces of the same coin. Although some analysts prefer FA while others give more importance to the TA, only both of them together can provide a clearer picture of an asset’s performance in the short or long run.

To Seek Investment Advice or Not?

For many people, the idea of being in charge of their finances is tempting. In times of prosperity, the bull market, and upward trends, careless investors start to feel profoundly successful, even invincible.

More cautious ones will seek advice. However, most advisors working in traditional financial institutions are not versed in crypto. Of course, they will not admit that directly. They will rather start to belittle the entire crypto domain, saying it is too volatile, too unpredictable, that it is an elaborate Ponzi scheme, that “Bitcoin is going to zero”, etc.

The truth is that the majority of people still do not understand crypto. Additionally, the global crypto market is still very thin – the market cap is low and the spread (the difference between Ask price and Bid price) is high. This labels cryptocurrency trading more as gambling than an investment activity.

Such behavior of an investment advisor is not necessarily a consequence of their ignorance. In most cases, they firmly do not believe in crypto and try to protect you. So, if you cannot turn to them, you will have to find alternative sources of information and investment advice. Luckily, there are many of them available for free, offering everything – from tutorials for absolute beginners to advanced trading techniques and in-depth trading strategies.

Also, some professionals are versed in cryptocurrency and blockchain – crypto advisors. They may be registered as investment advisors, registered representatives, or hold a credential like the Certified Financial Planner or Chartered Financial Analyst, but as the crypto regulations mature, we have been witnessing various agencies and bodies providing certifications for professionals specialized in trading cryptocurrencies.

Risks in Crypto Trading

Major risks of trading cryptocurrency are volatility, lack of regulation, and hacker attacks.

We have already covered volatility – extreme price fluctuations as a regular occurrence in cryptocurrency markets. Lack of regulation is a systemic issue that has been remedied lately. Industry standards, national laws and regulations, and stem of the international governance have been making the crypto environment safer.

On the other hand, numerous proponents of blockchain and cryptocurrencies oppose the idea of regulations imposed by the authorities, seeing that as a death threat to the liberties secured by the decentralization brought by the blockchain.

Hacker attacks can result in stolen funds or loss of access to the account. In both cases, recovery from damage is often hard, sometimes even impossible.

The hackers’ methods are diverse and highly effective. Therefore, every investor should take some precautionary measures to minimize the risks involved.

Not Everybody Will Make Profit, But Why Not You?

Cryptocurrency trading offers a unique chance for virtually everybody to become a veritable investor. Unsubstantiated claims spread by different individuals or the media that all cryptocurrency traders are entitled and will make profits are deeply false. Like trading any other asset class, every investor is exposed to both profits and losses.

However, if you dedicate yourself – your time and attention to the rules, happenings, and trends that are shaping the cryptocurrency market, you will have an opportunity to make some substantial financial gains alongside your primary occupation.

Crypto Ping Pong Digest

Trash style news. You will definitely like