Table of Contents

Intensively promoted through advertising campaigns and sponsorships of sports teams and events, Crypto.com has gained a huge amount of attention from the general public. Once recognized mostly by crypto enthusiasts, Crypto.com has the aspiration to become a global leader in the decentralized finance industry and the entire cryptobusiness domain. Today, Crypto.com is a well-organized hub for people’s dealings with cryptocurrencies and related finances.

History and Background

Crypto.com Domain Sold After 29 Years

Although you might have seen it a year or so ago on Lionel Messi’s or Joel Emdiid’s jersey, the Crypto.com domain has been registered for full 29 years! Matt Blaze, a professor of computer and information science at the University of Pennsylvania, initiated the existence of the domain in 1993 and it has attracted a vast amount of interest since the explosion of crypto in recent years.

The domain was not for sale until the perfect buyer has arrived. Kris Marszalek, a Polish crypto entrepreneur based in the Far East and the founder of Monaco (MCO), a company once known for being among the first to issue a blockchain-based debit card, cashed out an undisclosed amount of money for the desired domain. Unconfirmed rumors estimated the transaction was worth 10 million dollars, but the general impression was that it was worth every penny of it.

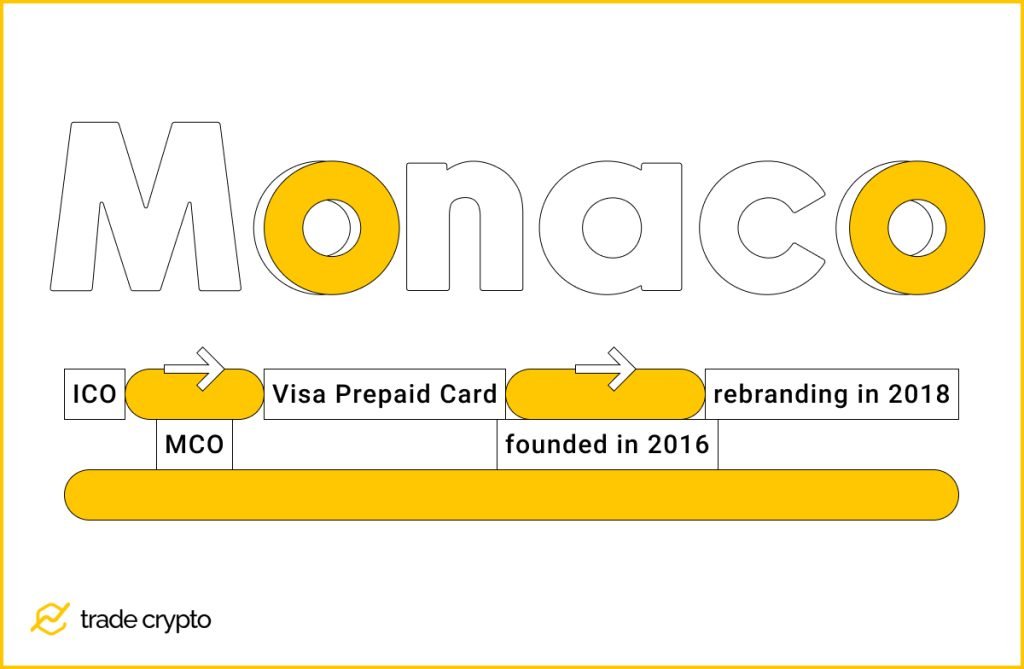

Monaco: ICO, MCO, Visa Prepaid Card

When Kris Marszalek founded his company in 2016 and branded it ‘Monaco’, he immediately stuck up among his startup peers with his statement: “If you are a founder starting on your journey to help build Web3, remember this: You don’t need VC money!”. He was right – the ICO (Initial Coin Offering) substituted the role of VCs and helped Marszalek raise $25M, which inflated fast to $200M.

The above statement was characterized as ‘bold’, but the boldness will certainly become one of the key features of Kris and his entire endeavor.

Back in 2016, only a handful of crypto enthusiasts knew about Monaco, the predecessor of Crypto.com. Devised as a crypto payment platform, Monaco was one of the first companies to offer blockchain-based debit cards. The MCO Visa prepaid card helped the customers buy and spend cryptocurrency easily, while the MCO wallet and cash app allowed them to manage and buy cryptocurrencies on their smartphones in a streamlined and efficient way.

The cards also offered free ATM withdrawals, tap-and-pay features, no annual fees or minimum balance requirements, up to 5% back on all local or overseas spending, and free shipping.

Total Rebranding

In 2018, the company was re-branded to Crypto.com and that was the moment when the mass markets started to learn about it. Giving sponsorships to various sports clubs and events (Philadelphia 76ers, Paris Saint-Germain soccer club, Formula 1 racing tour, etc) heavily raised the project’s global brand awareness, which is to be boosted furtherly by sponsoring one of the globally most cherished sporting events – FIFA 2022 World Cup in soccer.

Crypto.com also closed a multimillion-dollar deal with the Los Angeles Staples Center to rebrand it to Crypto.com Arena. The $700 million worth deal will secure the rights to keep the Crypto.com name on the arena for the next 20 years and it represents one of the most significant investments in sports by a crypto company.

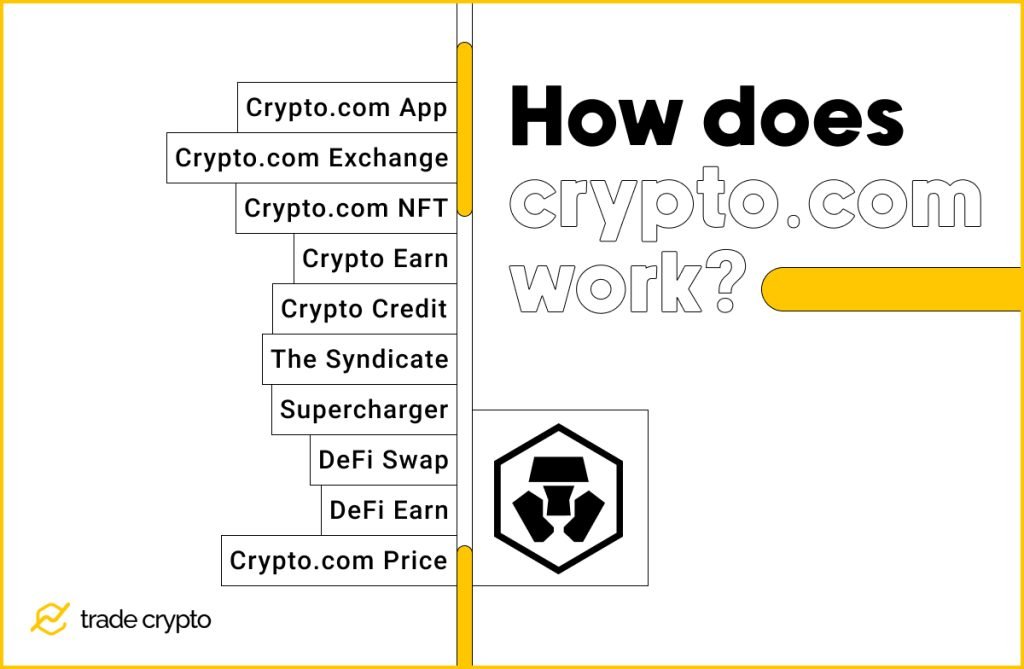

How Does Crypto.com Work?

First, we have to emphasize that Crypto.com is neither ‘a crypto website’ nor (only) a crypto exchange. It is a comprehensive cryptocurrency hub that consists of many different, yet compatible and interoperable services:

- Crypto.com App allows you to buy over 250 different cryptocurrencies and manage your Crypro.com Visa Card.

- Crypto.com Exchange is a frequently visited digital marketplace where you can buy and sell cryptocurrencies.

- Crypto.com NFT users can review NFT artistic collections made by both various renowned and unknown artists (and brands) while allowing users to buy NFTs using just their payment card and sell their collectibles in the Marketplace.

- Crypto Earn is a sub-platform for depositing (staking) your crypto assets, providing you with substantial p.a. interest. Interests are paid weekly, in the same currency as the deposit.

- Crypto Credit is a crypto loan platform with up to 50% LTV.

- The Syndicate: Crypto.com Exchange traders can access The Syndicate and buy top cryptos for up to 50% off.

- Supercharger: App and Exchange users can deposit the platform’s native token (CRO) into the Supercharger pool and earn DeFi tokens as rewards. The reward allocation is performed every day and is based on the quantity of assets provided by the user.

- DeFi Swap is a fork of Uniswap V2 that allows users to swap DeFi coins at the best available rate. They can also connect to and safely store their crypto in the Crypto.com DeFi Wallet.

- DeFi Earn enables users to receive returns by depositing their tokens into the protocol with the highest APY at the time of the deposit.

- Crypto.com Price – Crypto.com price page provides an opportunity for users to track the latest token prices, market movement, market capitalization ranking, and general token information.

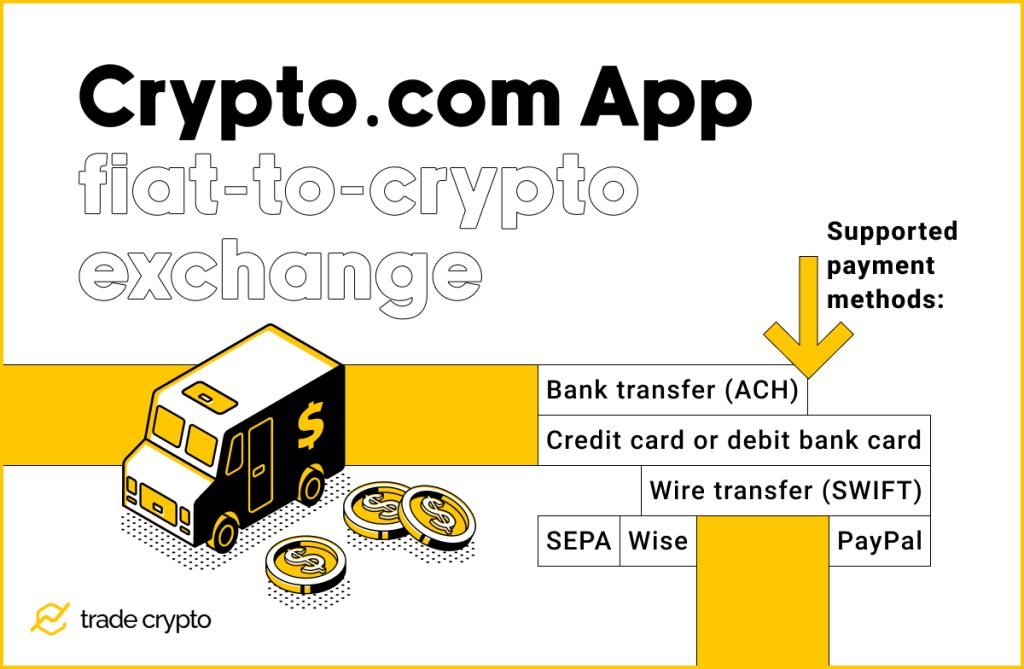

Crypto.com App

Crypto.com App is a popular fiat-to-crypto exchange with around 15 million registered users. The trading app provides a fast, easy and safe way to buy crypto at face value using a debit or credit card. The App is mobile-only (iOS and Android operating systems supported) and cannot be used on a desktop PC.

Crypto.com App is available worldwide (USA included) to purchase cryptocurrency using a payment card. Supported countries include the USA, Australia, Singapore, the United Kingdom, and some European countries.

To buy, sell, send and receive cryptocurrency using Crypto.com, all you have to do is to download the app from Google Play or Apple Store and verify the account using your cell phone and a valid email address.

Like most reputable fiat-to-crypto exchanges, new users that create an account with Crypto.com to buy and sell crypto using fiat currency will need to verify their identity. The ID verification process is to comply with AML regulations mandated by countries worldwide and is extremely intuitive, easy, and user-friendly. A full legal name and a government-issued identity document have to be submitted using the app.

The App supports many different fiat currencies. Money can be deposited to the App by following payment methods (subject to availability):

- Bank transfer (ACH)

- Wire transfer (SWIFT)

- Credit card or debit bank card

- SEPA

- Wise

- PayPal

The most popular method to transfer fiat currency in the USA is via a bank transfer (ACH) or a wire transfer. For higher limits, users are able to deposit up to $250,000 using a wire transfer which has a faster deposit speed of 1-2 business days. There is a minimum deposit amount of $50,000 with a wire transfer, quite adequate in comparison with other US cryptocurrency exchanges.

Crypto.com App allows the deposit of many digital assets such as BTC, ETH, CRO, BAT, LINK, USDC, or DOT. Certain supported coins and ERC-20 tokens are restricted in particular countries.

Crypto.com Exchange

Crypto.com Exchange is a part of the platform that can be accessed and managed from your desktop computer and web interface.

The user interface is quite decent and to a great degree comprehensible even for beginners (at least it is not any more complicated than the others). Of course, finding the way through various options and features can be a challenge. However, Crypto.com Exchange is at the top of the industry standards and the learning curve is not steep even for a novice.

All relevant navigation buttons are located on the upper side of the screen, with easy-to-use drop-down menus. As the majority of any crypto exchanges mostly stick to spot trading, Crypto.com sets it as the default view.

A newly added feature is OTC (over-the-counter) trading for VIP and institutional traders and investors. Orders worth between 50,000 USDT or equivalent and 1,000,000 USDT or equivalent are executed within seconds, with the platform’s engine providing the parties with a custom quote instantly.

“We prefer to build mobile-first – there is no reason for you to use a desktop if we deliver a design that works brilliantly on your phone. More broadly, we believe there is an enormous opportunity in crypto space to build great mobile experiences” is an official quote of a service provider’s representative. Although we may find this statement correct and legitimate, we do hope they will continue to pay at least some attention to their web presence, as it is nearly exceptional.

Crypto.com NFT

Non-fungible tokens (NFTs) have been a new, hyped product of blockchain technology. Representing a form of art that is digitized, tokenized and stored on the blockchain, NFTs take precedence over palpable, physical forms of traditional art among crypto aficionados.

On the other hand, NFT is also a new investment opportunity where anyone can be a digital artist (or collector) and try to sell their creation on the marketplace. Crypto.com NFT did not want to miss the chance to jump on a bandwagon and created its own NFT marketplace. So, if you are a Philadelphia 76ers or Lega A Calcio fan, for example, you will find some unique artworks dedicated to these (and many other) brands.

Lending Platform

Although not available in every jurisdiction, the execution of Crypto.com’s crypto lending platform is commendable.

If you want to take a loan, you can do it in USDC, USDT, BTC, and ETH and the list of supported coins is regularly expanded. As collateral, you can deposit CRO, LTC, BTC, ETH, VET, LINK, and DOT.

The LTV (Loan-to-Value) ratio of your loan is calculated by using a composite index price, which incorporates multiple price data from major exchanges.

Interest accrues daily at 00:00:00 UTC based on the unpaid loan principal. Interest rates are determined by the initial loan’s LTV and the amount of your CRO stake in the Crypto.com Exchange. Loans are up to 12 months in length, but they can be repaid in full before the maturity date.

Crypto.com Fees

Fees are an important element when reaching a decision on which centralized exchange to use, especially for intensive, frequent traders. Crypto.com’s fee structure is very reasonable, though different products are charged differently.

The App lets you deposit the assets free of charge and allows free crypto-to-crypto exchanges. Transfers of the Exchange and DeFi Wallet are not charged either. However, there is a fee for crypto withdrawals to an external address and its amount is different, depending on the cryptocurrency being withdrawn.

The Crypto.com Exchange charges trading and withdrawal fees. The trading fees are determined by your 30-day trading volume and the principle is simple – the more you trade, the less in fees you will pay.

You can also decide to stake the platform’s native CRO token and use it for paying fees with progressive discounts as your staking amount grows. As an additional bonus, you will be receiving 10% p.a. interest on your staked CROs. To become eligible for discounted fees, you have to pass the KYC verification and deposit at least 5,000 CRO.

For example, new Crypto.com users without any CRO staking will pay 0.4% on trades with a total monthly trading volume of less than $25,000. Higher-volume traders can become eligible for fees starting at 0.04% as a maker or 0.1% as a taker (also without CRO staking), going up to 0.4%.

Discounted trading fees are available when you hold at least 5,000 CRO in your wallet. At that point, traders with up to $25,000 in monthly volume pay 0.36%. Rates decrease with a larger stake.

There are no additional per-trade fees, so Crypto.com is competitive when it comes to pricing.

Purchasing cryptocurrencies directly by using your credit/debit card is charged between 0% and 3.5% in card fees, depending on the location of the user (country of issuance).

Crypto.com DeFi Swap allows you to link your own Ethereum wallet to the platform so you can easily swap different ERC-20 tokens. In most instances, you will pay 0.3% to liquidity providers to support the running of smart contracts.

If you connect Defi Swap to your Crypto.com Defi Wallet account and start transferring cryptos on the Ethereum network, you will have to pay gas fees. Depending on the desired speed of the transaction (average, fast, or super-fast), you will be charged a different gas fee.

Cryptocurrencies available on Crypto.com

Crypto.com supports more than 250 currencies/tokens for spot trading, with a certain amount of them supported for staking. With such a wide selection of coins, you can count on the ability to trade with all major digital assets available in the market.

Crypto.com App allows the deposit of many digital assets such as BTC, ETH, CRO, BAT, LINK, USDC, or DOT. Some of the supported coins and ERC-20 tokens are restricted in particular countries.

Such a large number of supported currencies guarantees a plethora of available trading pairs, thus allowing any trader to cater their investment exactly to their needs.

Security Provided by Crypto.com

Every respectable crypto service provider is deeply dedicated to keeping the platform, assets, and customers safe. Crypto.com has the license to operate in dozens of different jurisdictions and one of the requirements for obtaining them is having strong, systemic security measures in place. The platform is the first cryptocurrency company in the world to have ISO/IEC 27001:2013, ISO/IEC 27701:2019, PCI:DSS 3.2.1, Level 1 compliance.

A robust compliance monitoring and storing of the customers’ deposits offline in cold storage help prevent hacks and losses. Together with local banks in the U.S., there is a $250,000 in FDIC insurance on U.S. dollar balances.

Various security measures include multi-factor authentication (MFA) and whitelisting, to help keep customer accounts safe. Of course, it’s also important to use a strong password and personal online security practices to help protect your account.

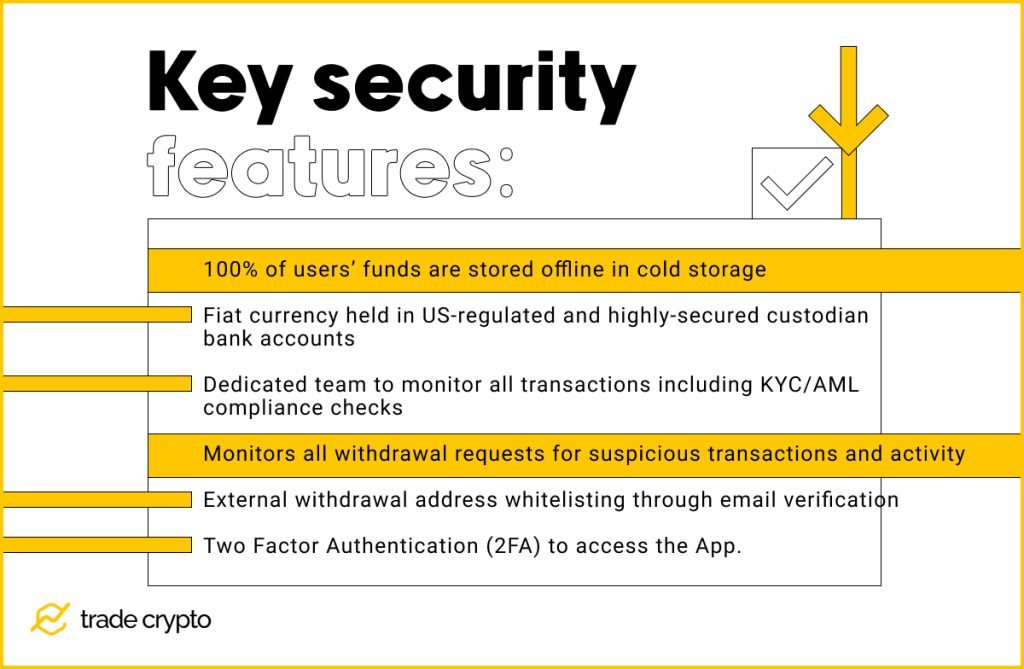

Some of the key security features are:

- 100% of users’ funds are stored offline in cold storage

- Fiat currency held in US-regulated and highly-secured custodian bank accounts

- Dedicated team to monitor all transactions including KYC/AML compliance checks

- Monitors all withdrawal requests for suspicious transactions and activity

- External withdrawal address whitelisting through email verification

- Two Factor Authentication (2FA) to access the App.

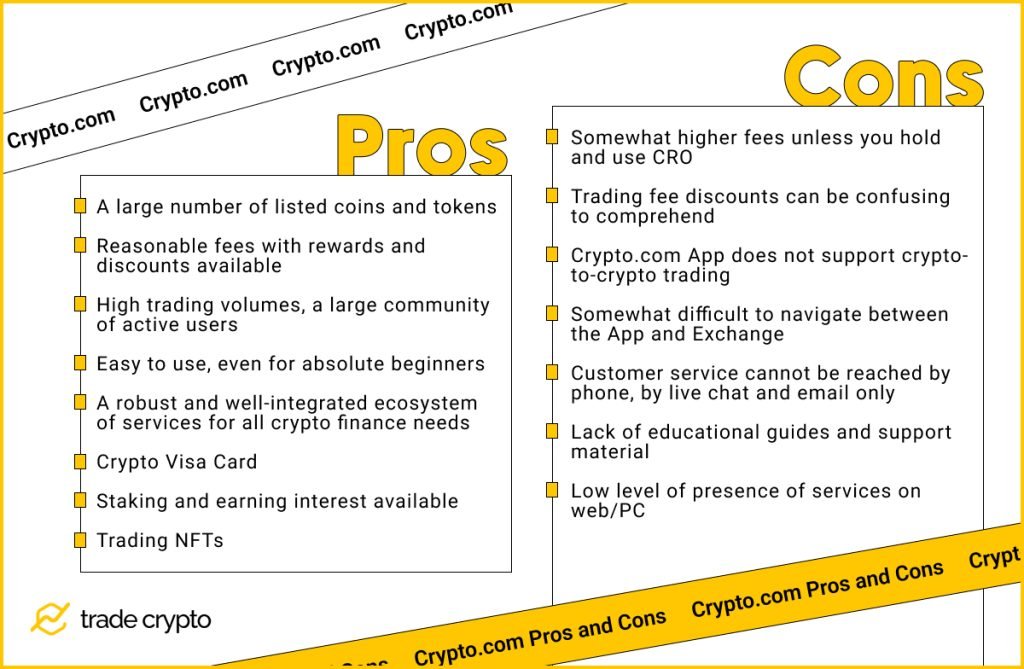

Crypto.com Pros and Cons

Is Crypto.com Safe?

The biggest fear regarding a crypto platform user is that it would be hacked and funds stolen. Although the risk can never be fully eliminated, it can be substantially mitigated, with proper risk management and funds recovery policies in place.

In January 2022, 483 Crypto.com users were hit by a hack, leading to unauthorized withdrawals of Bitcoin and Ether worth $35 million. No customers suffered a loss of funds as the platform fully reimbursed the affected users. That was the first and so far the last confirmed instance of a successful hacking attack against Crypto.com.

The incident was a moment to remember that the safety of crypto assets is a two-way street and that both the service and customers have to fulfill their part of the job of keeping the funds safe.

As we mentioned, Crypto.com keeps 100% of its user funds in offline cold storage. The security solution was devised in partnership with Ledger, and utilizes its institutional-grade custody solution Ledger Vault.

This cold storage has insurance coverage of $500 million, which includes direct and indirect coverage via custodians, physical damage, and third-party theft.

The funds kept in its hot wallets are corporate funds and constitute just a fraction of the company’s total holdings, which are sufficient for day-to-day withdrawal requests from customers.

When it comes to infrastructure security, Crypto.com uses Amazon Web Services (AWS), one of the most reliable and safest cloud computing service providers.

An internal safety&compliance department monitors all deposits for KYC, AML, and ATF compliance. A thorough screening is also performed on every withdrawal request.

On the user side of things, Crypto.com lets you protect your accounts with two-factor authentication (2FA), as well as a combination of a passphrase, password, biometric (fingerprint & face ID), email, and phone verification. Besides, its DeFi wallet lets you keep your private keys, meaning that you can self-custody your funds instead of relying on the security of the platform.

If you do want to trust Crypto.com with your funds, it is a highly secure and regulated crypto platform with numerous security certifications and assessments by top security auditors.

Crypto.com follows the highest industry standards regarding the implemented security and safety measures and therefore can be considered one of the safest crypto platforms on the market.

The Best Alternative to Crypto.com

As Crypto.com is a comprehensive hub for many different crypto-related financial operations, it is not always easy and accurate comparing it with other platforms.

Should we limit our assessment to the App and Exchange only – which are the two most important parts of Crypto.com’s ecosystem – we must define the comparison criteria.

Among the most important ones are: the number of fiat and cryptocurrencies supported for depositing, trade, and withdrawal; the number of listed coins and tokens that form an abundance of trading pairs; favorable fee policy; user-friendly interface (even for beginners); robust liquidity; tight security with hacking prevention; seamless interoperability with other platform’s features, etc.

With those criteria in place, we may see an alternative in Binance or Coinbase. But, we have to mind the fact that some of the globally recognized exchanges do not operate – partially or fully – in the United States and that the US citizens have to select those that are licensed to work in the States.

Having this in mind, we can name a few decent competitors of Crypto.com: CEX.io, Gemini, and Kraken.

But, if we compare it only with the biggest competitor, Coinbase, we will see that Crypto.com charges less in fees (up to 0.40% for trades, while Coinbase Pro charges 0.50%). Furthermore, Crypto.com supports more than 250 currencies, while Coinbase supports just something over 150. On the other hand, Coinbase is a more intuitive, user-friendly platform that may be easier for beginners to navigate than Crypto.com.

Crypto Ping Pong Digest

Trash style news. You will definitely like