Table of Contents

Anyone who’s ever traded crypto has heard of Binance. When we compare the trading volume on all crypto exchanges in the world, we can see that this trading platform easily dominates the crypto industry in this regard. Namely, the trading volume on the Binance exchange, on most days, is at least five higher than on any other exchange. Moreover, Binance offers low trading fees and support for an impressively large number of different cryptos.

These factors, and others, have made Binance the best crypto exchange in the eyes of many traders. However, as you know, virtually all aspects of the dynamic crypto industry are constantly changing. You can never be certain whether what you knew yesterday still applies today. The goal of our Binance review, thus, is to examine the current state of this crypto exchange, in order to find out if it’s still got what it takes to be considered one of the best exchanges out there.

And, there’s always the matter of security in the crypto realm. Obviously, unless it’s safe, no exchange belongs in the pantheon of the best crypto exchanges. Therefore, the question of safety is also the one we must answer in this article. Without further ado, let’s begin!

Binance History and Regulatory Issues

The story of Binance’s success begins in 2017, when it was founded by Changpeng Zao (also known as CZ), a Chinese-Canadian financial software developer. Zao’s name and his company Beijie Technology had already inspired some confidence, as Zao was, for instance, Blockchain.com‘s technical director prior to founding Binance. The crypto exchange became rather popular soon after its launch in 2017, and has remained so since.

Binance did encounter issues with the Chinese crypto regulations, however, which affected its operations as it was based in China. This forced Binance to relocate to Japan, and then to Malta, which both had complaints pertaining to the decentralized manner in which the crypto exchange functioned.

Recently, Binance was looking to set up offices in the United Kingdom. However, the country’s Financial Conduct Authority had issues with Binance refusing to supply the regulatory body with basic information pertaining to the exchange’s operations. Generally speaking, as the crypto industry is becoming increasingly regulated, Binance’s decentralized manner of doing business has been a thorn in the eye of governmental institutions.

Currently, the company doesn’t have traditional headquarters, but has offices in France, Dubai, and on the Cayman Islands. While still being essentially decentralized, Binance now does have a better relationship with institutions in the countries where its offices are located. For instance, the opening of its French branch marked the first time that Binance attained the approval of an EU regulator. Binance and its manner of operating, therefore, are evolving in an effort to keep up the pace with overall regulatory changes in the crypto industry.

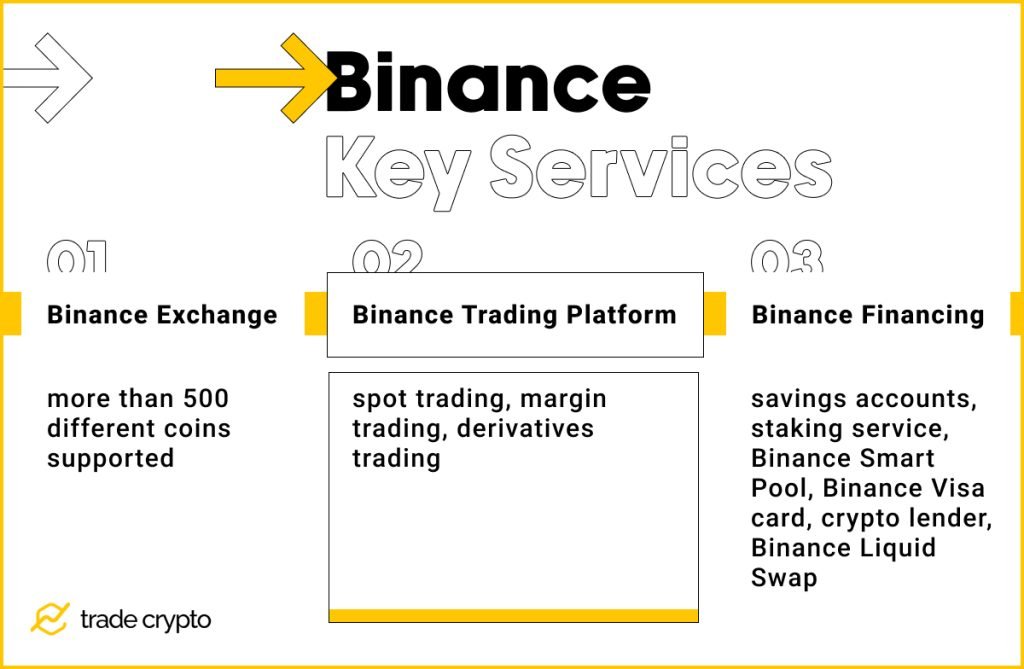

Binance Key Services

Since it was founded, the list of services that Binance provides has been becoming longer and longer. Today, this is a well-rounded trading platform, that provides a wide range of services to users. In this section of the article, we’ll examine all the key features that one can utilize on Binance.

Binance Exchange

Binance’s first function is to provide a place where users can buy/sell crypto by using fiat currency. More than 500 different coins are supported.

Binance recommends the use of the Trust Wallet. This is a hot wallet, meaning that the funds kept in it are connected to the internet. It comes with support for thousands of different cryptocurrencies. Therefore, it’s able to handle all the coins you may acquire on Binance. With Trust Wallet, but also other external wallets, withdrawing and depositing assets on Binance is easy.

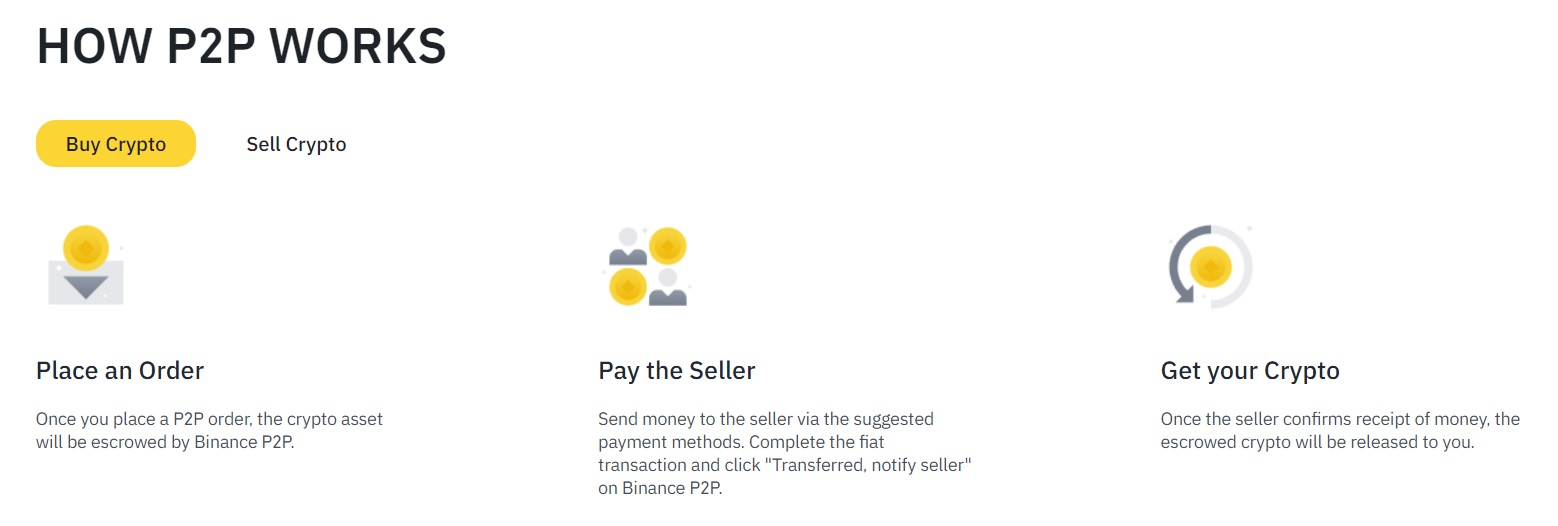

There are several neat ways for users to buy/sell crypto on Binance. The first one is the P2P (peer to peer trading) option, which directly connects buyers and sellers. This is an excellent feature that provides various means of payment. Parties involved in the transaction are bound to find a method of payment that is convenient to them.

Another way to acquire crypto on Binance is to buy it with fiat currency, by using wire or SEPA (Single Euro Payments Area) transfers. This is a great option since there are no transaction fees involved at all.

Unfortunately, not all users will be able to utilize it, as this method of payment doesn’t work with all fiat currencies. Namely, wire transfers are available for USD, TRY, and BRL, while SEPA works with GBP and EUR fiat currencies (unless you’re a citizen of the Netherlands or Switzerland, in which case you won’t be able to buy crypto in this way).

Lastly, in partnership with Simplex, Binance also provides the option to buy crypto, or deposit a fiat currency into your Binance account, by using a credit or debit card. However, there are large fees involved when using such cards. When making a USD deposit with a debit card, you can expect to pay a 4.5% fee.

Binance Trading Platform

Generally speaking, Binance’s trading platform is top-notch. As we said, Binance offers a long and impressive array of some 500 supported coins. There’s a substantial selection of crypto and crypto-to-fiat trading pairs.

Moreover, Binance offers many advanced trading options for experienced traders, but you can easily adjust its user interface so as to be more approachable to beginners.

The care that has gone into Binance’s design in order to make it beginner-friendly is commendable. We can see that in the way that Binance handles spot trading. Experienced traders have at their disposal advanced features such as order books, different order types, and charts. On the other hand, through the so-called “convert” user interface, beginners can choose to remove this data in order to easily view different cryptos’ market prices.

There’s also the margin trading feature for some trading pairs, providing up to 10% leverage. In other words, you can multiply your profit by 10 percent, but also your losses.

When using cross margin trading, users are putting their entire margin account balance on the line. On the other hand, with isolated margin trading, users are only risking losses corresponding to one trading pair.

Since 2019, there’s also the Binance Futures option. Instead of buying or selling crypto, with Binance Futures users are speculating on the future price of crypto.

Binance Futures offers up to 20% leverage. The user interface is very similar to Binance’s interface used for spot trading, but there are some additional options. For instance, it allows customers to view open positions or control leverage.

Binance has separated the Futures balance accounts from the regular trading accounts. To use Binance Futures, you’ll need to provide collateral with Tether (USDT). The same stablecoin is also used to realize gains and losses. However, under the separate Coin Futures tab, there are also futures on Binance that use non-stablecoin crypto as collateral, such as Bitcoin.

Lastly, there’s also derivatives trading. The so-called leveraged tokens offer up and down contracts when betting on cryptos’ value. The advantage of leveraged tokens is that they, as the name implies, provide leveraged exposure to different crypto, while eliminating the chance of liquidation.

However, as we’ve mentioned, Binance ran into trouble with the governmental regulatory bodies in several countries in Europe. According to the regulators, Binance is not an authorized provider of investment services. Therefore, Binance’s derivative trading option is unavailable in many European countries, including the United Kingdom, Italy, Germany, Spain, and the Netherlands.

Binance Financing

Binance’s newest key service revolves around various financing options. For starters, there are Binance savings accounts, that provide a passive income on idle funds. You can choose between a locked or flexible savings account. The former provides higher interest rates on a fixed-term deposit. On the other hand, the latter provides variable interest rates.

Binance’s staking service enables one to stake coins and earn a profit on proof-of-stake and DeFi (decentralized finance) coins. A benefit that this service provides is that you don’t need to possess the technical knowledge on staking the coins by yourself.

Therefore, this is a neat option for users who are interested in receiving a passive income, but do not have the time or the inclination to learn how to stake on networks such as Ethereum. This service also lets you choose between a locked and flexible staking account.

Conversely, there’s also an option connected to proof-of-work mining. Namely, the Binance Smart Pool feature connects miners into a group whose members split the mining rewards. A convenient characteristic of Binance Smart Pool is that it doesn’t require any optimization from the miners. That is because it automatically directs the hash power toward a cryptocurrency that is the most profitable one at that moment.

Binance also offers a handy Binance Visa card. This card was designed so as to allow you to purchase things with crypto even in stores that only support fiat currency. Whenever you make a purchase, the Binance card converts crypto into fiat currency and then processes the payment. As for the fees for the conversion – there aren’t any! Moreover, the card is completely free, and you shouldn’t expect hidden fees whatsoever if you begin using it.

Apart from potentially being extremely useful in allowing users to shop with crypto, the Binance Visa card also provides customers with up to 8% BNB (Binance Coin) cashback on some purchases. Overall, Binance has done a great job with this card.

Furthermore, Binance also functions as a crypto lender. It offers similar services as other established lenders, such as AAVE, Alchemix, or CoinLoan. You can take out a loan in a wide range of different tokens. More popular tokens, such as BTC and ETH, serve as collateral for each of the tokens you loan.

Binance’s lending service makes it easy to obtain stablecoins such as USDT, USDC, or BUSD (Binance’s own stablecoin). At the same time, exposure to your crypto holdings is maintained and you don’t have to pay taxes, unlike when selling crypto, which makes this lending service an alluring one.

Finally, Binance also offers an AMM (automated market-maker) platform. Binance Liquid Swap is based on a pool of liquidity. In each pool, there are two tokens. The price between these two tokens is determined by the relative amount of tokens. Users can provide their liquidity and get a share of fees in return. Or, they can trade coins with Binance Liquid Swap with a minimum amount of slippage. Large transactions involve lower fees and more stable prices.

This all sounds, and is, a lot like the service that the crypto exchange Uniswap provides. However, one rather important difference between these two services is that Binance Liquid Swap is centralized.

Binance Fees

One area where Binance has excelled since it’s been founded is its fee structure. In other words, the fees you’ll need to pay on Binance are remarkably low and provide a substantial advantage in Binance’s claim to the title of the best cryptocurrency exchange.

The fees for spot trading start at 0.1%. Unless you need to immediately liquidate the fiat currency, you’ll certainly be pleased with this rate. The lowest fee on some other exchanges is higher than 0.2%, which is a lot more costly than what you’d need to spend on Binance, especially if you’re placing large orders.

Moreover, Binance’s VIP level system can make the fees go even lower. This system looks at the trading volume you’ve accumulated over a period of 30 days and assigns you a corresponding VIP level. Users at the highest VIP level of 9 will need to pay a 0.02% fee for maker orders, and a 0.04% fee for taker orders.

And when using Binance Futures trading, the VIP level system provides even lower rates. There are the same rates of 0.02% and 0.04%, but in the case of futures trading, these rates apply for VIP Level 0 users. On the other hand, VIP level 9 traders get to enjoy the total lack of fees for maker orders when using the Binance Futures trading platform, and the low 0.01% fee for taker orders.

There are no fees for placing deposits, as is the industry standard. Although, there are blockchain fees that the sender will need to pay. Withdrawal fees also correlate with the fees paid for the blockchain transaction. In an effort to provide a fair price, Binance is regularly updating the withdrawal fees for both crypto and fiat currency.

Binance Security

Generally speaking, Binance is a safe crypto exchange, that obviously takes its duty of protecting the customers’ funds with a high degree of professionalism.

Most of the funds are kept in cold storage, which means they’re not connected to the internet. This provides a substantial layer of protection that funds kept in hot wallets do not enjoy.

10% of trading fees are kept in a secure fund. The purpose of this fund is to cover any losses sustained from hacker attacks. This isn’t ideal, as it would be better if Binance worked with third-party insurance companies, but it does provide protection for users.

There’s a common two factor authentication for users, as well. Traders also have at their disposal the option to whitelist some addresses in order to allow withdrawals to those addresses only. In other words, if the whitelisting option is used, only the pre-approved wallets can withdraw funds.

So far, so good. We should mention, however, two notable cybercriminal attacks that were aimed at Binance in the previous years. These suggest that cybercriminals are always looking for flaws in crypto security that they can exploit.

The first one, a phishing attack, occurred in 2018. Luckily, the criminals have not managed to steal any funds.

What’s interesting in this case, however, is Binance’s reaction. Namely, Binance offered a bounty of $250,000 to anyone who could help identify the culprits. Two years later, the exchange received a report, made by a team of investigators who’ve managed to collect the necessary information on the attack.

Binance passed off the report to the authorities, which lead to the indictment and the still ongoing pursuit of the attackers. The team of investigators received $200,000 of bounty money from Binance, with $50,000 to follow when/if the perpetrators are apprehended.

The second attack occurred in 2019 and had more serious consequences. Namely, the hackers then stole more than $40 million worth of Bitcoin from Binance. The exchange claims that this was a highly skilled and well-organized attack, which used a variety of attack methods. The attackers have not been identified, but Binance did cover the stolen funds and no users were affected.

As of yet, no users have lost their funds on Binance. Crypto exchanges will always be an alluring target for cybercriminals, and attacks, some of which may be successful, will certainly occur in the future. So far, Binance has proven that it takes great care in protecting its users.

It would be more advantageous if Binance also worked with a third-party insurance company, but we can’t say the users should be concerned about the safety of their funds.

Binance Customer Support

Binance’s customer support is mostly in line with the high quality of its services. There’s a detailed FAQ section, that will be of assistance with most of the problems you may have. Moreover, Binance is known for its Binance Academy, which is an excellent educational resource. It’s not unusual for crypto-enthusiasts to utilize the Binance Academy, even if they’re not users of the Binance crypto exchange.

For additional assistance, there’s an online bot that will try to locate the answers to your questions. Finally, you can also chat with someone from Binance’s customer support team.

Generally speaking, it’s unlikely that you’ll need to wait long before receiving answers. The customer support team is friendly and is likely to solve whatever issue you may be having.

There are some reports, however, of users with Binance verification issues that weren’t resolved in a timely manner. This has been the issue ever since Binance introduced compulsory verification of users’ identity, which is necessary because Binance is a centralized exchange.

We can’t tell yet whether the high waiting times in cases of verification issues are a temporary issue resulting from high traffic, or if it’s a persistent problem with Binance’s customer support crew. We can assume that it’s the former, as the customer support team’s performance is practically spotless in all other areas.

Binance vs. Competitors

In order to determine whether Binance is, indeed, the best crypto exchange out there, we must first compare it to its competitors. We’ll take a look at the centralized exchanges that offer similar services: Coinbase Pro, Bittrex, Bitfinex, and Kraken.

In terms of fees the users need to pay, Binance is a clear winner. On Coinbase Pro (which is Coinbase’s trading platform), the lowest possible fee you may encounter is 0.6%. On Bittrex, it’s 0.35%. In both cases, Binance fees are significantly lower – 6 and 3.5 times lower, in fact.

Bitfinex functions with a maker/taker fee structure. Maker orders are handled with a maximum 0.1% fee, which is similar to what Binance charges. However, taker orders on Bitfinex are charged 0.2%, which is two times more costly when compared to Binance.

Kraken uses the same maker/taker fee structure. The maximum fee for makers is 0.16%, and the maximum fee for takers is 0.26% – both of which are higher than the fees you’ll need to pay on Binance. Therefore, Binance: 1, other exchanges: 0.

We’ve already mentioned that Binance supports over 500 different cryptos. Out of its four direct competitors, Bittrex supports the largest number of coins – 330. The rest of the competing exchanges all support less than 200 coins. Binance: 2, other exchanges: 0.

Furthermore, we can’t think of any relevant trading features that these four exchanges support, but Binance doesn’t. As we said, the Binance platform can be used by beginners, but the more experienced users will be able to utilize a wealth of advanced trading options. It’s very hard to find faults in the selection of services that Binance provides.

Therefore, we remain at Binance’s two-point advantage over its competitors, and we can proclaim the winner.

Binance U.S.

It’s now time to finally address the elephant in the room. Namely, there are not one, but two Binances out there. Due to the crypto regulations being different in the U.S., there is now the regular Binance, which does not provide services to U.S. citizens, and there is its sister company – Binance U.S. Being, among other things, an excellent lending platform that’s largely unavailable in the U.S., Binance brings to mind the also outstanding and also unavailable in the U.S. platform, BlockFi.

The sister company was formed by Binance in partnership with BAM Trading Services, and is managed independently from Binance. While Binance U.S. offers most of the advantages that Binance has, the one big difference (apart from availability to U.S. citizens), is in the number of supported cryptos. Due to the U.S. regulations that limit the type and number of different cryptocurrencies that an exchange can sell to U.S. citizens, Binance U.S. can only offer some 50 cryptocurrencies. Thus, it was more advantageous for Binance to create its sister company, while focusing the old Binance’s operations on the international market and countries other than the U.S.

However, Binance U.S. does provide low fees and attractive features that Binance has been known for. Additionally, while Binance U.S.’s liquidity pool is, naturally, much shallower due to the smaller market that it serves, it’s still sufficiently large for most traders. In fact, only the very biggest traders might encounter difficulties with the size of Binance U.S.’s liquidity pool.

Taking everything into consideration, the result in the Binance U.S. vs. Coinbase Pro/Bittrex/Bitfinex/Kraken match is 1:1, as Binance U.S. offers a lower number of different cryptos than the competitors. It’s unfortunate that U.S. citizens have been rid of the international Binance’s services, but that’s life.

Summarization

In brief, we believe that Binance can still claim the title of the best centralized crypto exchange. However, the situation is somewhat different if we’re talking about Binance U.S. This sister company offers a ten times lower number of supported cryptos than Binance International.

The U.S. counterpart is a good exchange anyway, but it’s hard to call it the best centralized exchange that U.S. citizens can trade on. Choosing the best such exchange would require an article of its own but, taking all factors into account, let’s just say that our current favorite is Coinbase.

The international Binance offers a huge variety of trading services that will satisfy both inexperienced and advanced traders. It provides very low fees and has impressive support for over 500 cryptocurrencies. There’s no reason to suspect that user funds are unsafe on Binance. In short, there’s nothing not to like about it, as non-U.S. citizens can find out first-hand.

Crypto Ping Pong Digest

Trash style news. You will definitely like