Table of Contents

The popular crypto exchange and lending platform, BlockFi, has been making the news recently. In early June, BlockFi was forced to lay off 20% of its staff, due to the negative impact of shifting global economic conditions. The company also had to eliminate all non-critical vendors, and reduce its executives’ compensation and overall marketing budget. Such news is unfortunate, but isn’t surprising anymore, as many crypto firms have been hit by adverse market conditions.

Moreover, in February, BlockFi had to pay $100 million in total, as part of the settlement with the U.S. Securities and Exchange Commission (SEC). BlockFi was accused of failing to register its yield returns and failing to comply with the Securities Act.

Before the layoffs, BlockFi reviews painted it as a solid platform, with mostly satisfied investors. After the news, however, it’s only natural to wonder whether BlockFi has still got what it takes. Answering this question is precisely the aim of this BlockFi review. Read on to learn whether using BlockFi is a good idea and what can you expect from it.

BlockFi General Info

BlockFi was envisioned as more than just a crypto exchange. On the contrary, this platform takes a rather holistic approach, offering a variety of products and services. These include crypto-based lending, a crypto rewards credit card, and interest-savings accounts. BlockFi’s highly developed loaning and borrowing services put it roughly in the same category of protocols as AAVE, Alchemix, or CoinLoan.

The BlockFi company was founded in 2017, and is based in Jersey City, NJ. Its founders are Zac Prince and Flori Marquez, who are still running the firm. Since 2020 and before the June 2022 layoffs, the number of BlockFi’s employees had risen from 150 to 850. Even after the recent setbacks, BlockFi has remained a respectable company in the world of crypto, and one that is seemingly striving to provide the best service for its users. Whether or not it succeeds at that is a complicated matter, that we’ll do our best to resolve by the end of the article.

BlockFi Key Features

As we said, BlockFi is not your run-of-the-mill exchange. In the following section, we’ll discuss the key features that this platform offers. These are four of them: interest-savings accounts, lending services, BlockFi crypto-reward credit card, and BlockFi crypto exchange.

1) Interest-Saving Accounts

BlockFi offers crypto interest-savings accounts that, essentially, function much like any bank saving account that deals in traditional fiat currency. Let’s examine this potentially lucrative feature in-depth.

Interest Rates & Insurance on Interest

BlockFi savings program allows users with cryptocurrency holdings in their interest bearing accounts to make between 3% and 8.6% in compounding interest. Through the Payment Flex option, users can choose in which cryptocurrency they’d like to receive the interest. The exact interest rate is determined by the currency type and will change according to the current market values. Generally speaking, even the lowest Tier 1 interest rate of 3% is decent enough.

If you’re confused by the phrase “compounding interest” in the previous paragraph, you should know that it is the type of interest that also provides “interest on interest”. In other words, not only do the users earn interest on the money they’ve invested, but this initial interest also earns the users its own, additional interest.

We’ve mentioned that BlockFi interest accounts function rather similarly to traditional bank saving accounts. However, the major difference is that BlockFi interest accounts, unfortunately, aren’t FDIC insured. This kind of insurance protects the investors from possible bank failures, and provides the investors with a guaranteed insurance policy of up to $250,000, which is protecting their crypto holdings.

The popular crypto exchange Coinbase, for example, does provide FDIC insurance, so its absence on BlockFi is certainly a drawback. The same goes for the absence of the SIPC insurance, which generally protects brokerage accounts.

Another flaw in BlockFi’s interest bearing account offer is the lack of custodial accounts. Such accounts are opened in the name of the parent, who is the custodian of the account until his or her child turns 18. This is a very useful option for parents, as the account funds, while protected from inflation, can generate a substantial interest that can help to put their kids in college, for example.

BlockFi’s Plans for the Future Pertaining to Interest bearing Accounts

Very recently, on June 24, BlockFi announced that it will be raising the users’ interest rates, despite the difficulties that the BlockFi company is facing. The raise will be effective as of July 1. The interest rates are high enough as it is, so this increase seems like a truly generous act, made possible by the decreasing market competition.

For example, the tier 1 APY (annual percentage yield) for BTC and ETH investors will be 3.5% (for comparison, currently it is 3%). Tier 1 APY for stablecoins USDC, GUSD, PAX, and BUSD will be 8.5%. And Tier 1 for Tether (USDT) will be 8.75%. For additional info on the interest rate increase, we’ll point you in the direction of the relevant page on BlockFi’s website.

When discussing user costs, the good news is that BlockFi doesn’t charge any trading fees, apart from the small margin fees. As for the withdrawal fees, the platform is currently offering one free withdrawal per month for some assets, including BTC, LTC, and stablecoins GUSD, USDC, BUSD, PAX, DAI, and USDT.

However, the bad news is that, starting on July 1, there will be no free withdrawals at all on the BlockFi platform! BlockFi claims the changes pertaining to withdrawal fees were made due to the high withdrawal demand from users. Therefore, a fee of up to $25 is necessary in order to cover the company’s costs, which can no longer afford to freely honor withdrawals.

On the other hand, BlockFi also announced that the withdrawals will be less costly, also starting from July 1. Still, as 75% of all BlockFi monthly withdrawals were free in 2022, there’s no doubt that the investors will now have to spend additional money on fees. In the eyes of some users, even the one-per-month free withdrawal was not enough. For such users, this will be a substantial downside.

Unavailable in the U.S.

Another, for some investors even more serious drawback, is related to the aforementioned trouble with SEC that BlockFi experienced. Namely, since February, BlockFi no longer offers interest-saving accounts to new clients from the U.S. (!), as their savings accounts were not registered under the Securities Act.

Moreover, those clients from the U.S. who already had a BlockFi interest account are no longer able to transfer assets onto the account. This is, obviously, a significant issue that makes it impossible for many investors to use the BlockFi platform.

2) Lending Services

BlockFi also functions as a lending platform. Borrowers place some of their crypto assets as collateral. The lending interest rate is then calculated based on the borrower’s lending-to-value (LTV) ratio. You can find out what the LTV amounts to by dividing the amount of the loan by the collateral. The lowest possible interest rate in the U.S. is 4.5%, and it applies to BTC-backed loans whose LTV is 20% or less. The highest interest rate is 9.75%, and it applies to all 50% or higher LTVs. Regardless of the LTV, for each loan, there’s a 2% origination fee.

The interest loan rates are rather low, which is BlockFi’s substantial advantage. Because of this, BlockFi is an attractive platform for those users who are in need of a quick cash influx.

Tax-Related Advantages

Borrowers on BlockFi can reduce the amount of crypto-related tax they’ll be paying. When you borrow crypto instead of selling it, you’re not obligated to report the borrowed amount as capital gains tax. Moreover, the interest is tax-deductible, which further decreases the amount you’d need to pay in taxes.

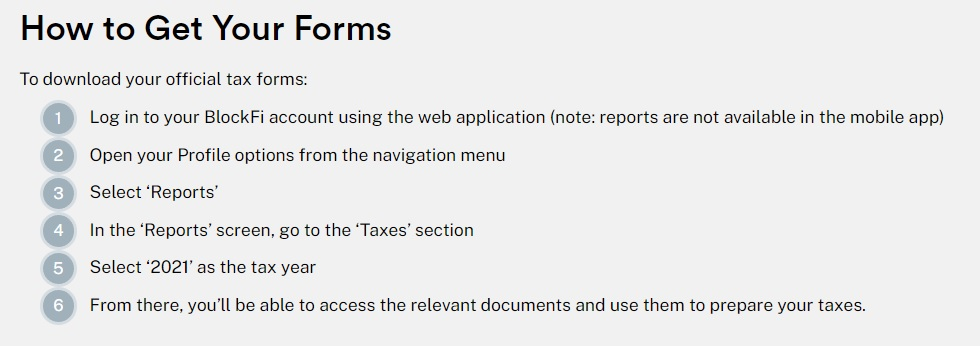

And while we’re talking about taxes, there’s another neat, tax-related detail that we should mention. Namely, for U.S. citizens, BlockFi provides a 1099 Form at the end of each year, that informs the investors about the exact sum in the interest they have received during the previous year. This will be useful to investors when it’s time to pay the IRS its due.

There is, however, a potential pitfall that borrowers will need to have in mind. The crypto market is volatile. If the value of your collateral drops, you could lose the collateral due to no longer having adequate value to support the loan. Therefore, borrowers will need to be extra careful.

3) BlockFi Rewards Visa® Signature Credit Card

The BlockFi card was one of the first credit cards to be aimed at crypto investors. This Visa card enables users to earn crypto, in the amount worth 1.5% of each purchase. For example, each time you spend $100 with your BlockFi card, you’ll gain $1.5 worth of crypto. You can choose between about 20 supported cryptocurrencies in which you’d like to redeem the points acquired in this way.

This card is completely free; there are no (hidden) fees. Unlike with some similar credit cards, there are also no foreign transaction fees. The BlockFi card can, thus, accompany you when traveling abroad.

You’ll likely need a FICO score of at least 670 in order to apply for this card, which is somewhere in the “good credit” range. You shouldn’t worry about the application negatively affecting your credit score if you’re not approved, as BlockFi will only run a soft credit check. Only when you get approved and accept the card will the BlockFi company run a hard credit check, but this check will have an insubstantial effect on your credit score.

What’s more, there are bonuses that users can be eligible for. The first one is a trading bonus amounting to 0.25% in Bitcoin, with a maximum of $500 worth of Bitcoin per month. 0.25% is not much but, as the saying goes, we’re not going to look a gift horse in the mouth.

The second bonus is the annual spending bonus. Users who spend $30,000 in one year (starting with the date the card is issued, not the beginning of the calendar year), will get 2% percent back on all qualifying purchases.

BlockFi Credit Card Drawbacks

Everything we’ve mentioned so far sounds (and is) good. However, the BlockFi card does have some serious faults when compared to its competitors, especially if you’re not already using the BlockFi platform. It makes sense for buyers with existing BlockFi accounts to use this card, as the rewarded crypto can be automatically transferred into their savings account, where it will generate interest. However, those users who’ll first need to register an account on BlockFi (which is a prerequisite for being able to shop with BlockFi’s credit card), will likely find better crypto-reward credit cards, that won’t require them to sign-up for an additional crypto exchange.

A smaller issue with this card is that, unlike some other credit cards out there, the BlockFi one doesn’t offer an introductory 0% annual percentage rate (APR). This means that, in this case, there’s no introductory period of time when the credit card company allows for no-interest purchases.

The main problem, however, is the 1.5% reward rate. While this isn’t bad per se, there are cards on offer that provide a 2% reward rate, such as the Wells Fargo Active Cash Card. As we said, BlockFi does offer a 2% rate, but only to those users who’ve qualified for the annual spending bonus. With cards such as the Wells Fargo one, there’s no point in using the BlockFi Visa credit card.

That is, unless you’re already an active BlockFi user, who’d like to have a synchronized credit card as well. Another instance where we can see how using the BlockFi card could be advantageous is if you were planning to open a savings account on the BlockFi platform (remember, for this to work, you can’t be a U.S. citizen). However, as the card is only available in the U.S., you can see that there’s a problem.

4) BlockFi Crypto Exchange

Let’s now take a look at the final key feature of BlockFi. Generally speaking, crypto trading on the BlockFi exchange is easy and straightforward.

You can trade on your PC, or by using a BlockFi mobile app for Android or iOS. After connecting your crypto wallet with the exchange, all you need to do is specify the currencies and the buy/sell amount. The interface is clean and elegant, making the BlockFi exchange comfortable to use.

Until recently, some users have avoided the BlockFi platform because it supported a rather limited number of different cryptocurrencies. Since May 2022, however, the BlockFi developers have added support for 14 additional crypto assets that non-US clients can trade with. These include Binance Coin, AAVE, and TRX. Of course, there was already support for the most popular coins, such as BTC and ETH.

Still, given that some exchanges, such as Binance, deal with hundreds of different cryptos, BlockFi will do well to further expand the supported list of crypto assets in the future.

BlockFi also provides a handy recurring trades option. With this option, you can automatize the purchase of crypto assets. The software can be set to purchase crypto daily, weekly, or on the 1st or 15th day of the month. The main idea behind this feature is to enable your savings account to automatically grow, and with it, the amount of your interest will keep increasing as well.

This is a truly neat and innovative feature. Unfortunately, like savings accounts, it is only available to users outside of the U.S., as well as to U.S. investors who have already opened a BlockFi account.

BlockFi Security

As we said, BlockFi doesn’t come with the FDIC or SPIC insurances. However, the platform does employ seemingly trustworthy safety measures. For starters, there’s the common method of protection, which requires new users to submit a government-issued ID, along with some personal information (legal name, country of residence, full address). There’s also the optional, but encouraged two-factor authentication for users.

As for the more advanced security measures, the first one is that there are reserves placed with third parties, such as Coinbase, BitGo, and Gemini. These reserves are kept in cold storage. Assets kept in cold storage are not connected to the internet, which means they’re generally more secure.

Furthermore, BlockFi only buys U.S. government-regulated investments; that is, the futures that are regulated by the CFTC (Commodity Futures Trading Commission), and equities regulated by the SEC. Finally, BlockFi’s collateral rates, of up to 50%, indicate that this is a careful lender.

Some respectable investors have backed BlockFi, allowing for additional optimism as to its level of security. This is no hard evidence, but given that Morgan Creek Capital Management, Valar Ventures, and Coinbase Ventures are all BlockFi investors, they must have thought that the investors’ funds are safe on BlockFi.

BlockFi also provides the “allowlisting” option. This security feature enables users to ban withdrawals from their accounts, or to limit them to some addresses only. This is a convenient option, that further lowers the possibility of theft.

Previous Hacker Attacks

We should note, however, that BlockFi suffered a successful hacker attack in 2020. The unidentified hacker infiltrated the BlockFi system through an employee’s mobile phone, and managed to access some of the BlockFi users’ information (names, addresses, activity histories). Luckily, no user funds were stolen. Extra sensitive information such as the investors’ social security numbers or bank account details also remained protected. The BlockFi company responded to this event by hiring a new chief security officer.

Then, in March this year, Hubspot, a tool used by BlockFi and other companies to organize their marketing campaigns, was also breached. Interestingly, this also happened as the hacker gained access to HubSpot employee’s phone. Luckily, the attack didn’t have any negative effects on BlockFi’s overall operations.

Despite these two incidents, however, BlockFi appears to be secure. Hacker attacks happen frequently in the realm of crypto, and no platform can ever be 100% secure. Generally speaking, the crypto industry is not well suited for users who aren’t prepared to take at least some risks. That said, we believe there’s no reason for investors to actively worry about possible thefts on BlockFi, as the funds and BlockFi’s treasury appear to be well protected.

BlockFi Customer Support

In general, BlockFi’s customer support service seems to be friendly and easy to reach. There are three possible ways to get assistance. You can submit an online ticket, speak with someone from the customer support service by phone, or chat with a chatbox.

However, we should mention that we’ve run into reports of investors who were dissatisfied with the amount of time it took for the customer support to reply. But, as users with such negative experiences are in the great minority, it’s safe to say that you can expect a smooth service with BlockFi’s customer support.

There’s also the help center on BlockFi’s website, which contains written articles that can answer the questions users may have. Unfortunately, there are no video tutorials, which tend to be even more helpful. The BlockFi team has put some effort into the help center, but there’s more work to be done in this area.

BlockFi vs. Coinbase

Now that we’ve examined the BlockFi platform in detail, let’s see how it compares to other platforms. In order to properly gauge BlockFi’s level of usefulness for its users, we first need to compare this platform with a similar one, such as Coinbase. Both are popular crypto exchanges, that enable investors to earn interest on their assets and receive crypto-backed loans.

Unfortunately for BlockFi, Coinbase comes out as a superior platform in this duel. On Coinbase, the investors’ crypto assets are protected by the FDIC insurance, making the investors more relaxed when it comes to their funds’ safety.

There’s support for over 150 different cryptocurrencies on Coinbase, which is much better than BlockFi’s limited support of some 30 cryptos. On the other hand, in BlockFi’s defense, this platform has excellent stablecoin support, as it can work with all the biggest stablecoins and offers a high interest rate on them.

One advantage that BlockFi has over Coinbase is that it doesn’t charge transaction fees. However, BlockFi does charge small margin fees, of about 1%, whenever the transaction’s trade prices are set. Still, Coinbase is more costly in this regard. If you were to buy $1000 worth of Bitcoin on both platforms, you’d spend about $5 more on Coinbase in fees ($15 vs. $10).

Finally, Coinbase offers savings accounts for U.S. users as well. The alluring savings account feature is one of BlockFi’s biggest qualities. It offers the users beneficial terms and enables them to begin accumulating interest quickly and automatically. However, if we eliminate this feature, there’s no doubt who the winner in the BlockFi vs. Coinbase match is (at least if you’re a U.S. citizen, that is).

Summarization

All in all, BlockFi is a tricky platform to recommend. If you asked us just six months ago, giving it a thumbs up would be easier. As it is now, BlockFi can be beneficial to users, but only under certain conditions.

Let’s quickly summarize. BlockFi provides a very good service in terms of lending, due to the low interest rates. If you’re in need of a loan, it’s more advantageous to borrow the funds on BlockFi, than to sell the crypto you already own. That way, you’ll be avoiding the capital gains tax. For such borrowers and their needs, it will be hard to find a better-suited platform than BlockFi.

Trading on BlockFi’s crypto exchange is an easy and smooth process. However, BlockFi only supports a small number of different cryptos, and the help center could have used more work.

BlockFi’s Visa credit card is okay. It awards the buyers with crypto after each purchase, and then places that crypto into a savings account, so that the users can earn interest as time passes. But, there exist crypto-reward credit cards that offer more crypto per purchase than BlockFi’s card.

The last, but certainly not the least, BlockFi’s interest accounts feature is not available to U.S. citizens who don’t already have a BlockFi interest account. This is a shame, since BlockFi is missing out on many potential investors. It’s even more unfortunate as the platform’s saving accounts provide the users with a neat source of passive income. Of course, BlockFi has many customers outside of the U.S., who are able to enjoy the steady income generated by the savings account. If you’re a citizen of another country who is looking to invest, you won’t go wrong with BlockFi.

Crypto Ping Pong Digest

Trash style news. You will definitely like